6 months expenses, not 6 months salary.

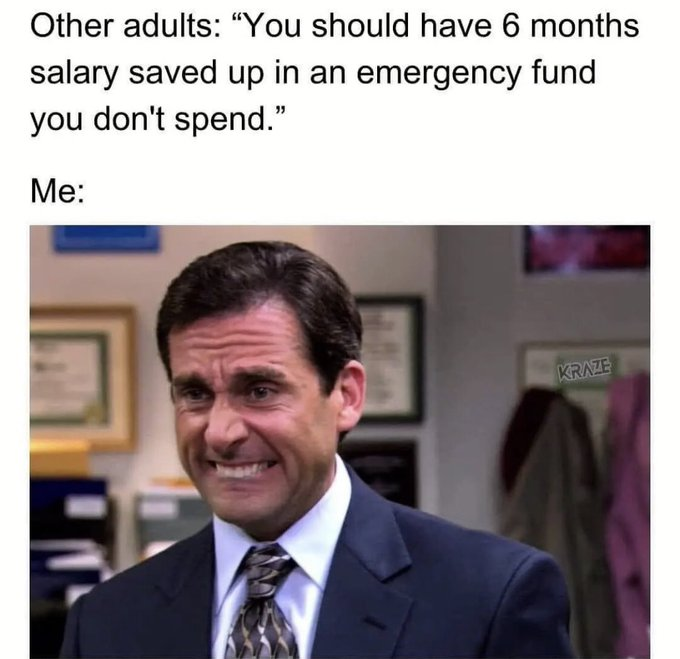

Memes

Post memes here.

A meme is an idea, behavior, or style that spreads by means of imitation from person to person within a culture and often carries symbolic meaning representing a particular phenomenon or theme.

An Internet meme or meme, is a cultural item that is spread via the Internet, often through social media platforms. The name is by the concept of memes proposed by Richard Dawkins in 1972. Internet memes can take various forms, such as images, videos, GIFs, and various other viral sensations.

- Wait at least 2 months before reposting

- No explicitly political content (about political figures, political events, elections and so on), [email protected] can be better place for that

- Use NSFW marking accordingly

Laittakaa meemejä tänne.

- Odota ainakin 2 kuukautta ennen meemin postaamista uudelleen

- Ei selkeän poliittista sisältöä (poliitikoista, poliittisista tapahtumista, vaaleista jne) parempi paikka esim. [email protected]

- Merkitse K18-sisältö tarpeen mukaan

When you are living paycheck to paycheck, that number is probably the same.

Didn't anyone notice during covid these "highly responsible business people" couldn't make it a couple months without the "to big to fail" bailouts or free covid money?

Months? Dune couldn't make it 2 weeks. Just standard issue capitalist hypocrisy.

It isn't 6 months salary, it is 6 months worth of expenses

So 9 month's salary - got it.

Oooff bruh

So if I want to accomplish this in a year I should be putting away half of every paycheck? Between rent, bills and groceries, who the fuck can afford that?

You can't accomplish it in a year.

Most people can't afford it in a year.

People who inherited a sizeable amount of money or are in the top 10% of earners are able to do so.

Yeah this is a 5+ year goal right?

I world say it’s getting to 3-months first, then paying down debt with high-interest rates, then trying for 6-months of expenses. Could easily take a decade, but the idea is that once you have that 6-months saved, it’s less likely that you’ll re-enter into high-interest debt in the first place.

Also, maxing out the $23.5K of the 401K retirement account.

Easy, have a side hustle selling drugs and pay everything cash.

Just stop eating and photosynthesize like the rest of us responsible adults

I had 9 months saved in 2020. I'm taking out loans this month because it's at zero. It's been a hell of a ride. This economy is fucked though.

In what universe is this even possible for most people? Because it's not this one.

Its possible in this one, it just isn't easy, takes a while, and generally isnt super pleasant.

When people say to "live within your means", they don't mean "don't spend more than you make", they mean "save enough to maintain your financial security".

I was that person until mid 2019.

Then some unexpected huge home expenses vaporized the emergency savings.

Then COVID happened and I lost my job! TWICE! This was after being an engineer at the same company for 16 years. My shit was stable AF before it all started.

Now I’m a much happier person with a much better job, but my finances are LOLfukt. Fortunately due to me trying to be careful in the past, I already owned a small cheap home in a reasonable COL area, so I can’t complain.

It is in this one. Unfortuanlty its not easy, and any medical event, car issue, house issue, or girlfriend can wreck that in a day.

I honestly think the "6 months of salary in an emergency fund"-advice is a bit overblown and certainly not universally applicable.

An emergency fund must per definition be very liquid in order to fulfill its purpose, hence you can only really place the money in a simple savings account with a not-so-spectacular interest rate. This means that the opportunity cost of having 6 months of salary in an emergency fund is the delta of expected return on investment in a higher-yield method of savings, such as placing the money in index funds. This can be quite significant, in particular since saving up 6 months of salary is not an easy task for the average person.

If you had the money placed in investments, the money would be less liquid, and there's the chance that you may have to liquidate it during a downturn, which would of course suck a little. Consider carefully under which scenarios you would have to liquidate, though:

- Lost your job? I have unemployment insurance to cover this scenario for me, meaning that I will get 80% of my current salary for close to a year, a period during which I would have to liquidate nothing.

- Disaster strikes my home? My home insurance policy covers this more than enough for me.

- Medical emergency? I'm lucky enough to live in a country where health care is free, but I have additional health insurance on top of that as well.

- Emergency while traveling? I have great travel insurance. They cover all medical expenses and would even fly me back home post-haste in disaster scenarios.

- Other accidents where I hurt myself? You guessed it, I have insurance for that too.

Now, there's an argument to be made that these insurance policies might be a bit slow to pay out, and that I might need to be a bit more liquid to cover the expenses temporarily. I have a solution for that too - credit cards. With credit cards I can make a short-term loan that should bridge over most issues until I can either get money from any of my insurance policies, or worst case have time to liquidate some of my higher-yield investments.

So yeah, that's my plan. It does not involve 6 months of salary being invested in a low-yield savings account, because that'd lose me a lot of money. I dislike the fact that the 6 months emergency fund is basically parroted as religious gospel, and it feels like people who repeat it have not thought about the issue thoroughly.

You seem to be in a very unique situation. And to have a pretty good understanding of personal finance and of your risk appetite. What you say works for you and a few people that happen to have access to universal healthcare, what looks like four separate insurance policies, and that can manage not to fuck it up with credit cards.

6 months liquid emergency fund remains the best strategy for most people out there.

Meanwhile giant megacorps after 2 weeks of lockdown go bust bcs free money.

Multiple times now, I've had people on Lemmy tell me that I am either not caring about my future or not caring about my child's future because I buy myself an occasional chai latte and her an occasional smoothie or some Taco Bell food.

I hate this idea that you should deny yourself any and all pleasures in life so that you can have a decent 10-20 end-of-life years when you retire. People made fun of the avocado toast guy, but suddenly now he's got the right idea?

I'm not going to have major retirement savings if I put the maybe $20 a month at most that this costs and it makes our lives a little less miserable right now.

Yeah, generally agreed.

I think more people should actually track what they're spending, though. Sometimes what feels like "just $20 every once in a while" isn't. A coworker of mine realized he was spending a lot more than he thought on fun food and drink when he actually added it up and put it in a spreadsheet.

Not saying that's you! But actually checking your spending in detail every once in a while I think is a good idea for everyone.

I'm 38 and I just achieved that goal.

Don't stress about this shit (too much).

Go to concerts, take trips, eat your avocado toast. Indulge.

You're only young once, and everyone is poor in their 20's. Unless you're lucky or it's given to you.

It sounds trite, but success will come. However you measure it.

I bet less than 25% of people actively do this. It's not that easy to do lol

True. But the meme is wrong. It's expenses not income.

The idea is you should be able to survive without working for 6 months.

This is to cover losing your job, injuries, illness, family emergencies.

Yeah man I got it saved up and then some, I was able to stretch it 11 months without work most of last year. I got lucky.

Nobody else I know has that luxury.

6 month of work just sitting thete getting eaten away by inflation doesn't spund smart. Either invest that shit or boof that shit while getting your dick sucked.

It is very smart. If you lose your job or have a major expense, not having to put it on credit provides you with a lot of stability, and you don't have to pay interest.

-someone still paying off 4 months of unemployment a year ago

You can have your emergency funds in a high savings account as long as you can withdraw it without a pnealty

You should have an emergency fund. You never know when something bad will happen. For all you know your house could get bulldozed or you car could get damaged by something the insurance doesn't cover

That's my problem: I start saving and then suddenly I have a huge expense and I need to empty out my savings. Happens at least every six months.

I'd argue that's proof of your emergency fund working! You were able to save enough money to cover an unexpected expense/emergency without having to go into credit card debt.

Kudos! You should feel proud of yourself!

It sounds like you built and then benefitted from an emergency fund. Nice!

That means it’s working. You’re doing exactly what you need to and it’s absolutely paying off!