this post was submitted on 30 Mar 2024

846 points (97.3% liked)

Memes

8511 readers

239 users here now

Post memes here.

A meme is an idea, behavior, or style that spreads by means of imitation from person to person within a culture and often carries symbolic meaning representing a particular phenomenon or theme.

An Internet meme or meme, is a cultural item that is spread via the Internet, often through social media platforms. The name is by the concept of memes proposed by Richard Dawkins in 1972. Internet memes can take various forms, such as images, videos, GIFs, and various other viral sensations.

- Wait at least 2 months before reposting

- No explicitly political content (about political figures, political events, elections and so on), [email protected] can be better place for that

- Use NSFW marking accordingly

Laittakaa meemejä tänne.

- Odota ainakin 2 kuukautta ennen meemin postaamista uudelleen

- Ei selkeän poliittista sisältöä (poliitikoista, poliittisista tapahtumista, vaaleista jne) parempi paikka esim. [email protected]

- Merkitse K18-sisältö tarpeen mukaan

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

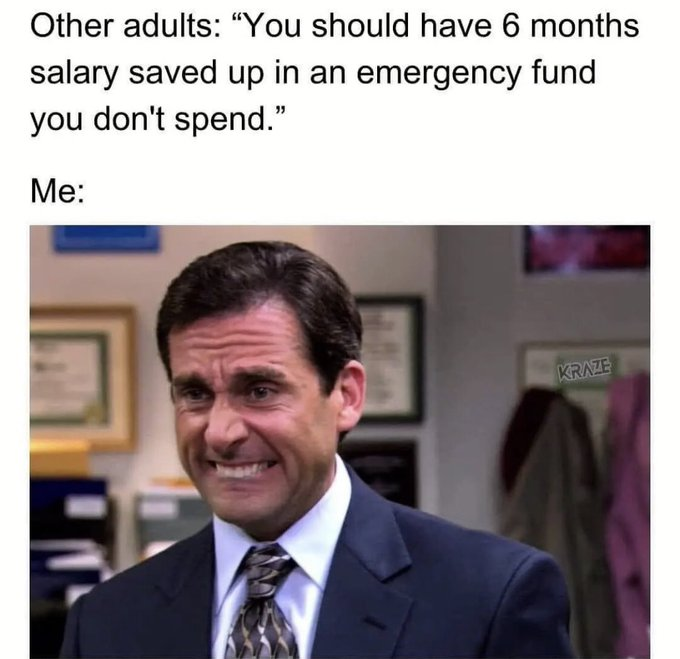

I bet less than 25% of people actively do this. It's not that easy to do lol

True. But the meme is wrong. It's expenses not income.

The idea is you should be able to survive without working for 6 months.

This is to cover losing your job, injuries, illness, family emergencies.

Yeah, I get that, that's why I meant I doubt that more than 25% of people can survive without working for 6 months. I don't think more than 25% of people have more than 6 months of expenses saved up.

56% of Americans don't have enough to cover a $1000 unexpected bill. So I'd guess less than 5% have 6 months of expenses saved.

I agree. I think is a mix of people living check to check (no choice) and bad education.

I came from no money and learned financial planning skills from the internet.

Now I'm at the point where I got an emergency fund and savings, but it took me years to get here.

I don't think it's fair to blame it on bad education. I'm pretty sure almost everybody is aware that having emergency savings is better than not having emergency savings. The cost of living keeps going up, inflation rate going way up, but salaries are just not increasing enough to keep up. Everything is becoming more expensive and people can't afford it, let alone having enough money to set aside for savings.

As far as bad education I'm referring to those growing up in poorer conditions.

Parents that live check to check and have issues with making rent, feeding the family and maintaining basics like a car and home electricity.

I grew up in this kind of environment. Financial responsibility starts at home. You follow your parents. Then at schools they dropped home economics. How to make a budget and not fall into debt.

I got real lucky with outside support because I looked for it. I also know people who wouldn't listen to me and used credit cards frivolously. Spending more than they earn over and over.

Yes everything is worse today, but 10 and 20 years ago people still made stupid financial decisions due to capitalism and ignorance.

The working class has been guided to farm wealth for the 0.1% for a long time.

I am 46 years old. I have never had enough to be able to survive without working for 6 months. Thank god for unemployment payments.

If you can't bring the savings side of the equation up, then bring the salary side down. Easy.

It's like 50% that can't afford 1k, let alone 6 months of expenses.

I did it by living well below my means for my first job.

That's all fine but at 16 you don't really have expenses.

I'd bet less than 5%.