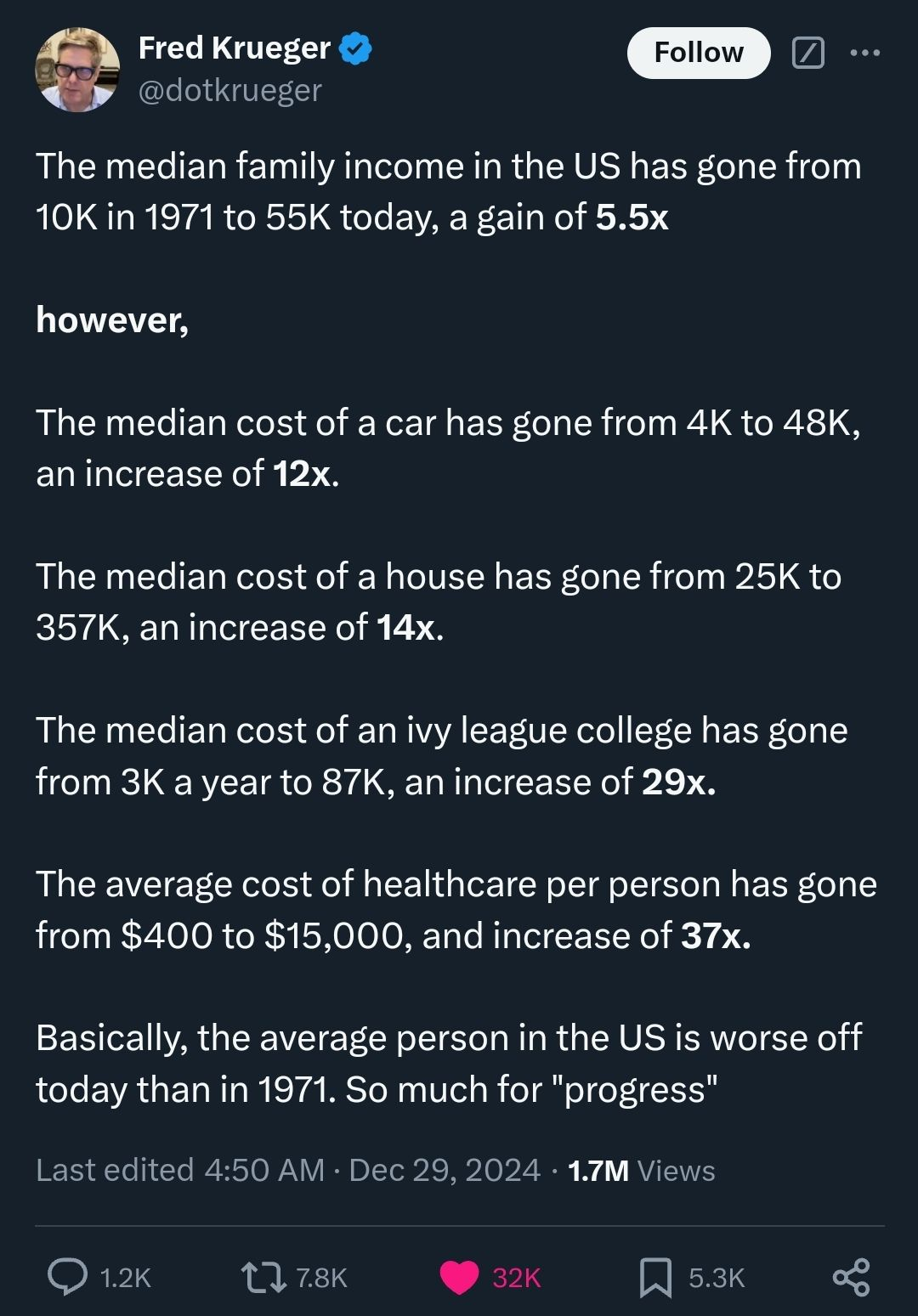

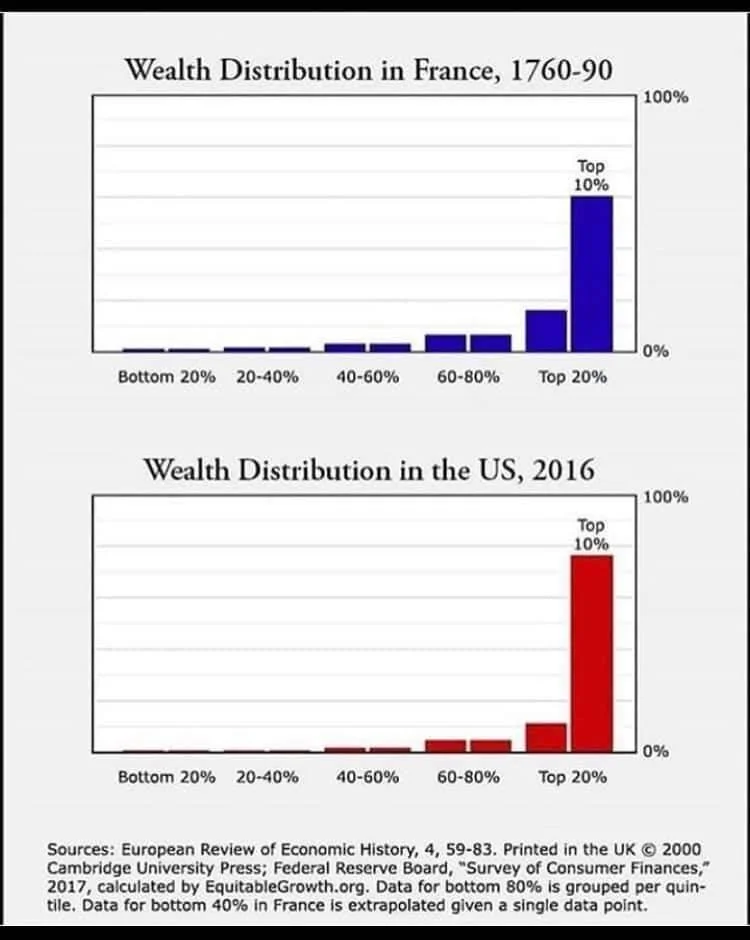

The wealthy are much better off though. If you looked at the wage increase of the top 1%, if has risen by $800,000 a year (https://www.commondreams.org/news/2019/12/09/staggering-new-data-shows-income-top-1-has-grown-100-times-faster-bottom-50-1970) since 1970.

So capitalism is working exactly the way it is supposed to. Exploiting the middle and lower classes for the rich. This is exactly the progress they want.