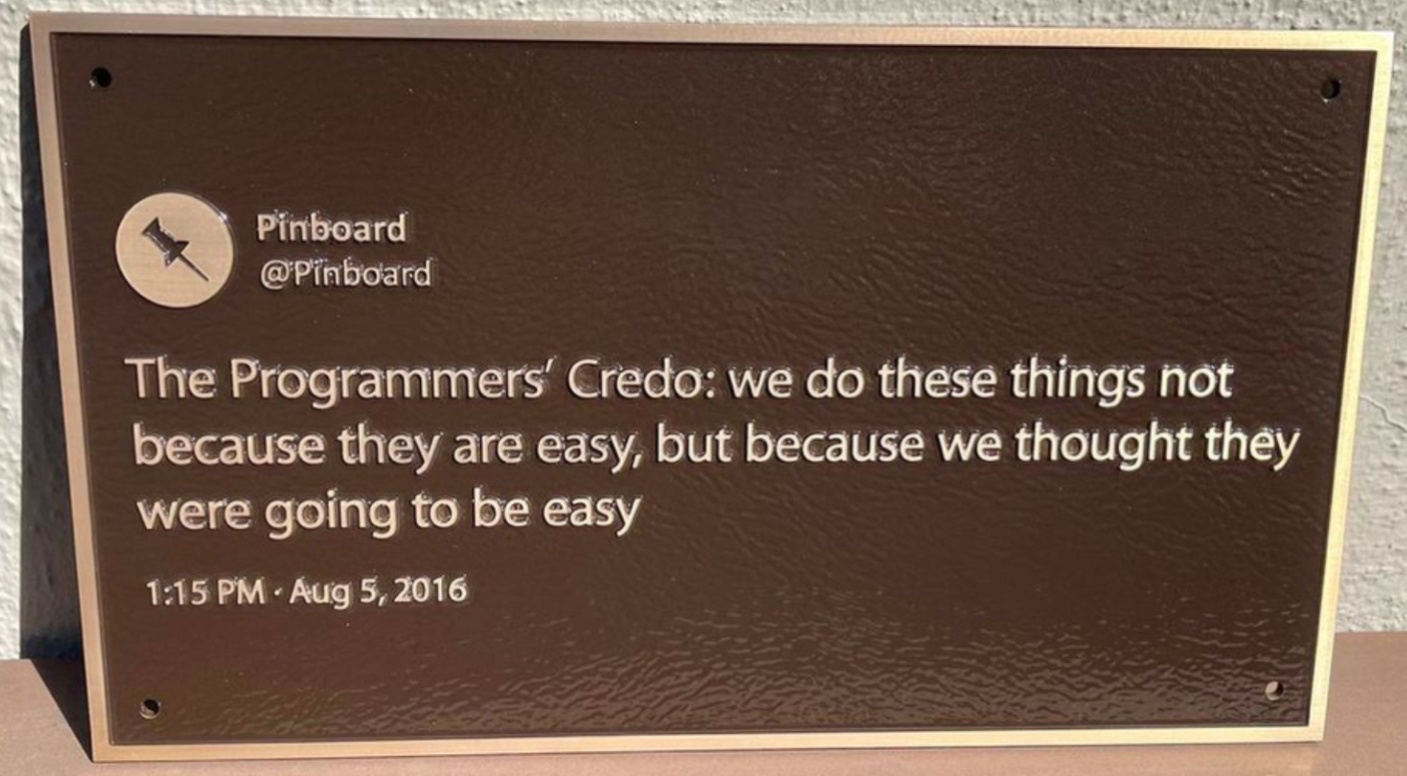

I'll pull THIS story. It'll be easy.

Bleeb

Zoning laws affect what you can build where. But a quicker route to increasing the supply of homes (this lowering prices) is to levy high taxes on single family homes that the owner does not live in.

Single family homes have become an investment opportunity for corporations and wealthy individuals. When vast sums find their way into a market, prices can go up sharply. Corporations, private equity funds, and the like cannot inhabit a home. And a person can only inhabit one primary residence (>50%). So if people (or companies) want to own homes as rental properties, they'd pay higher taxes. Some would sell those extra homes, reducing Demand and putting them on the market, increasing supply. The additional taxes some would pay to keep the extra single family homes could fund housing-related programs like section 8, redevelopment of depressed areas and so forth.

Can anyone with experience in housing policy with in? Would this work? Aside from pissing off rich people?

If I'm the product, I can always leave