this post was submitted on 15 Apr 2024

725 points (98.1% liked)

Funny

9044 readers

1208 users here now

General rules:

- Be kind.

- All posts must make an attempt to be funny.

- Obey the general sh.itjust.works instance rules.

- No politics or political figures. There are plenty of other politics communities to choose from.

- Don't post anything grotesque or potentially illegal. Examples include pornography, gore, animal cruelty, inappropriate jokes involving kids, etc.

Exceptions may be made at the discretion of the mods.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

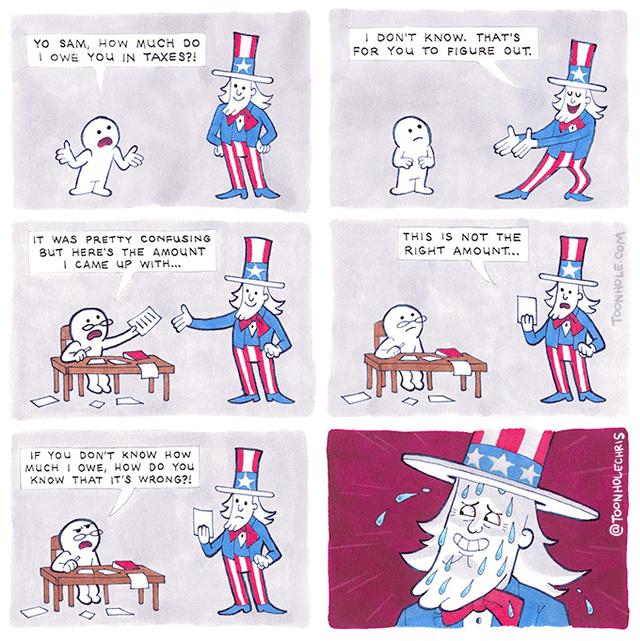

The answer of course is that the IRS doesn't know how much you owe, and it isn't feasible for them for figure out exact numbers for everyone with the tax code as complicated as it is. So, they audit a fraction of Americans every year to keep everyone honest. It's a bad system that taxes are so complicated but it's not a conspiracy.

It absolutely is a conspiracy though:

https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free

Except the federal government literally this year started instituting a free, public filling service to get around TurboTax. And they fought it tooth and nail.

There is a conspiracy, but it's not a federal government conspiracy. It's just a bad system that certain companies conspired to take advantage of.

I mean, the tax system is so bad because tax preparers like Intuit bribe politicians to keep it that way.

It is engineered the way that it is to provide loopholes for rich people.