this post was submitted on 07 Mar 2024

992 points (91.3% liked)

General Discussion

11946 readers

7 users here now

Welcome to Lemmy.World General!

This is a community for general discussion where you can get your bearings in the fediverse. Discuss topics & ask questions that don't seem to fit in any other community, or don't have an active community yet.

🪆 About Lemmy World

🧭 Finding Communities

Feel free to ask here or over in: [email protected]!

Also keep an eye on:

For more involved tools to find communities to join: check out Lemmyverse and Feddit Lemmy Community Browser!

💬 Additional Discussion Focused Communities:

- [email protected] - Note this is for more serious discussions.

- [email protected] - The opposite of the above, for more laidback chat!

- [email protected] - Into video games? Here's a place to discuss them!

- [email protected] - Watched a movie and wanna talk to others about it? Here's a place to do so!

Rules

Remember, Lemmy World rules also apply here.

0. See: Rules for Users.

- No bigotry: including racism, sexism, homophobia, transphobia, or xenophobia.

- Be respectful. Everyone should feel welcome here.

- Be thoughtful and helpful: even with ‘silly’ questions. The world won’t be made better by dismissive comments to others on Lemmy.

- Link posts should include some context/opinion in the body text when the title is unaltered, or be titled to encourage discussion.

- Posts concerning other instances' activity/decisions are better suited to [email protected] or [email protected] communities.

- No Ads/Spamming.

- No NSFW content.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

Wealth tax is a terrible idea. People think it will solve the problem with billionaires taking out loans collateralized with their stock and not paying income tax, but the solution for that is far simpler - just treat loans as income. You can even add an exception for an owner occupied mortgage if you want to keep encouraging forced savings into property. We have existing solutions that don't have the massive disincentives a wealth tax would create.

A wealth tax actually discourages investment through stocks, which is what keeps the economy moving (and before anyone says publicly traded companies thinking about short term profits is destructive, that's a separate, but serious, issue). Worse, it discourages savings of any kind. The problem with saying "oh we'll just start it only a billion dollars" or whatever is that allows for later expansion of the tax to 100 millionaires, 20 million, and boom suddenly you're taxing people with 5 million dollars which is what you'd expect a middle class elderly couple from a high cost of living area to have squirreled away for retirement. And if you don't think that would happen, you should look at the history of the income tax - because that's exactly what happened.

Also, a wealth tax is really hard to enforce, and would require a huge increase to the administrative state that itself would create a need for more taxes. That's not inherently a problem (obviously we have legions of IRS agents, etc) but we already have that infrastructure set up for income taxes and are just underutilizing it. Take how many lawsuits and hearings we already have JUST with tax assessors for property, and then try adding that to cars, boats, art, luxury clothes, appliances, privately held companies, anywhere you can hide money or that has a questionable value. It's a boondoggle we don't need to mess with when all we have to do is just reclassify collateralized debt as income because it is functionally the same as selling something.

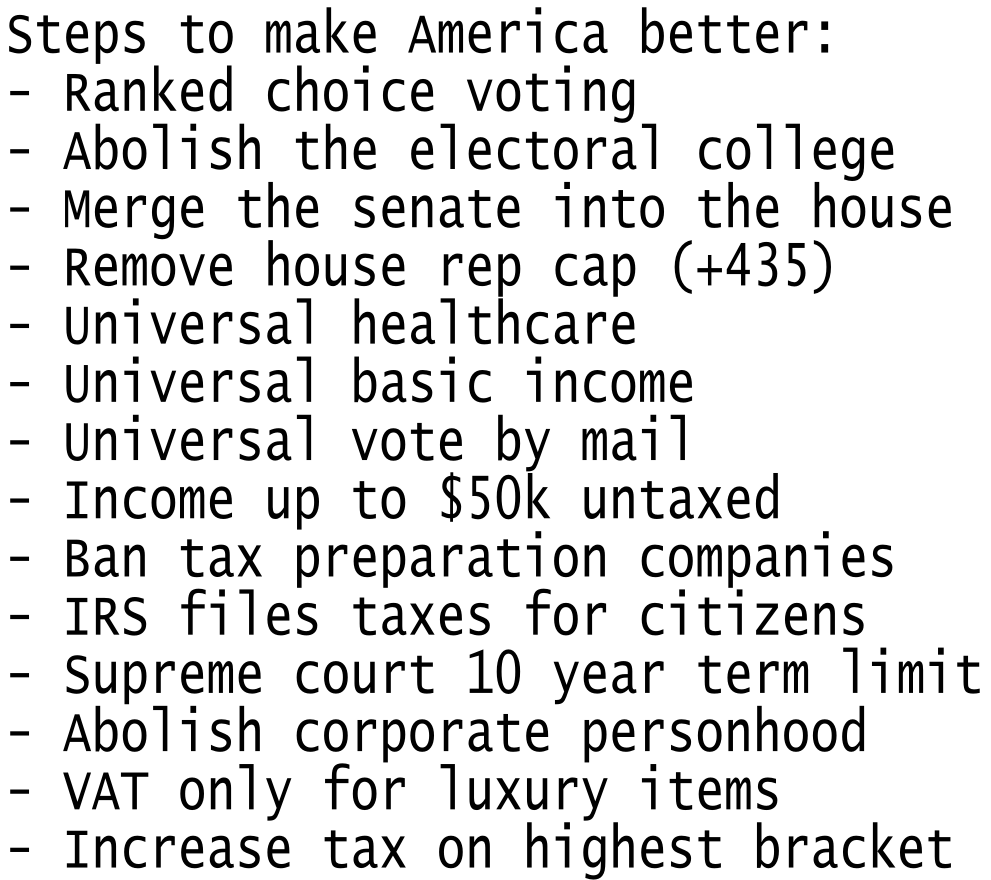

I like taxes. I even like my high taxes because I know they pay for good services since I live in a blue state. But a wealth tax is a bad idea when we already have income taxes and can add VAT taxes for luxury goods.

Ok, not a bad idea to tax loans...but now you're taxing people buying a home, car, financing a repair on something, etc. The point is to tax people with massive wealth, not to target someone like me who had to take out some financing to pay for a home heating boiler replacement. You could use a "well, except..." argument, but then I could counter with the same slippery slope argument you use later in your reply.

Why? Stocks are still the biggest way to increase wealth without lifting a finger to do any actual work. Maybe you get taxes more, but you're still making more money. You mean to say they're so greedy that not making billions fast enough would cause them a fit of pique? What else would the uber-wealthy invest in? Why not grow a business instead? They could also simply find a workaround to not take loans based on assets, boom, suddenly not collateralized. Enjoy your personal loan.

I disagree with the baseless slippery slope argument because you stated income tax while arguing retirement accounts. They are not the same thing, and that's why we're having this discussion.