this post was submitted on 07 Mar 2024

992 points (91.3% liked)

General Discussion

11946 readers

7 users here now

Welcome to Lemmy.World General!

This is a community for general discussion where you can get your bearings in the fediverse. Discuss topics & ask questions that don't seem to fit in any other community, or don't have an active community yet.

🪆 About Lemmy World

🧭 Finding Communities

Feel free to ask here or over in: [email protected]!

Also keep an eye on:

For more involved tools to find communities to join: check out Lemmyverse and Feddit Lemmy Community Browser!

💬 Additional Discussion Focused Communities:

- [email protected] - Note this is for more serious discussions.

- [email protected] - The opposite of the above, for more laidback chat!

- [email protected] - Into video games? Here's a place to discuss them!

- [email protected] - Watched a movie and wanna talk to others about it? Here's a place to do so!

Rules

Remember, Lemmy World rules also apply here.

0. See: Rules for Users.

- No bigotry: including racism, sexism, homophobia, transphobia, or xenophobia.

- Be respectful. Everyone should feel welcome here.

- Be thoughtful and helpful: even with ‘silly’ questions. The world won’t be made better by dismissive comments to others on Lemmy.

- Link posts should include some context/opinion in the body text when the title is unaltered, or be titled to encourage discussion.

- Posts concerning other instances' activity/decisions are better suited to [email protected] or [email protected] communities.

- No Ads/Spamming.

- No NSFW content.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

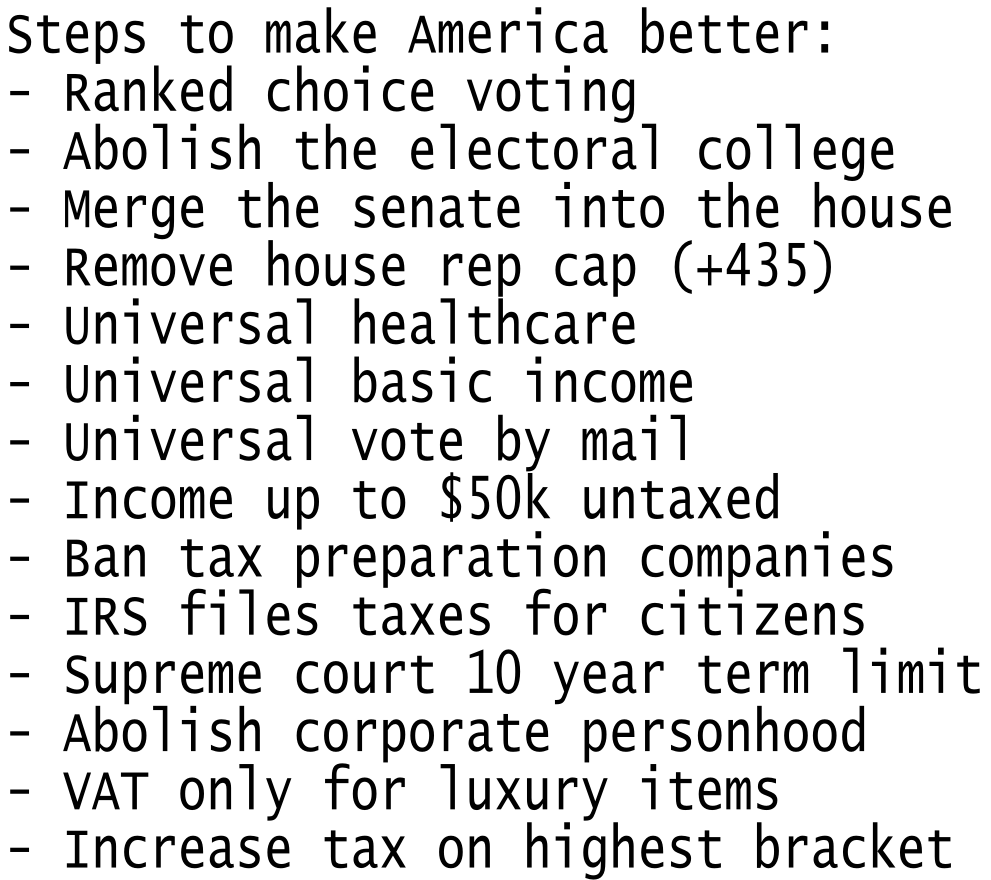

As a mathematician, I want to see this modified slightly (I will pair the original with my modification)

Income up to $50k is untaxed

Income up to $100k is untaxed (I have done the math, this would actually work with one of my other modifications)

VAT tax for luxury items

VAT for B2B sales based on the Value Added by their step in the production chain

Remove sales tax

Remove tax brackets - replace with a continuous function that has parameters to encapsulate the current credits and deductions, as well as new ones to encourage reasonable behaviors (green energy, having kids, not having kids, etc.)

Addendum to the above: business taxes fall get the same treatment, with parameters for things like the wealth/income gap ratio between the highest-paid employee and the median for the company, % of employees who reside in the United States, number of subsidiaries, number of technology acquisitions made. Oh, and companies that make more than $1M/yr never get a refund, period.

Require communities to cap rent, it is done by popular vote as a ballot measure, and the options are calculated based on local needs, cost of living, and median income for the town.

I have more, but I also have a headache.

Great list overall but I'm wondering what you mean by reasonable behaviors in regards to having kids or not? I understand the notion of encouraging and discouraging behaviors by legislation, but that can be difficult to negotiate/implement.

Honestly I included both because I wanted to include people who elect not to have children. Currently, the child credits are in place to strong arm people into having children, and there is no upper bound on the number of children it covers. This can really be a financial impediment for people who either have chosen not to have children or have not been able to. Conversely, families who elect to have an arbitrarily large number of children end up placing a disproportionately larger burden on social infrastructure. They elevate the load on schools more than other families, they consume more food than other families, etc. By tuning the how the parameter is calculated you can provide some refund for having no children, increase it to a point for small numbers, then level off or even reverse it as the number increases. Thus this provides some economic benefit for people making the very ecologically and financially rational decision not to have children, still helps ease the financial burden for people who have small numbers of children, and holds people who incur a higher social burden by their decision have many children. I am specifically leaving out numbers on these as the moral and ethical decisions of what constitutes 'few' and 'many' for this discussion are something that can and should be actively debated to determine the social validity. Also, it could be done in a way which would allow the tuning to be adjusted based on social needs for population growth.