this post was submitted on 11 Jan 2024

422 points (84.8% liked)

People Twitter

6874 readers

703 users here now

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a pic of the tweet or similar. No direct links to the tweet.

- No bullying or international politcs

- Be excellent to each other.

- Provide an archived link to the tweet (or similar) being shown if it's a major figure or a politician.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

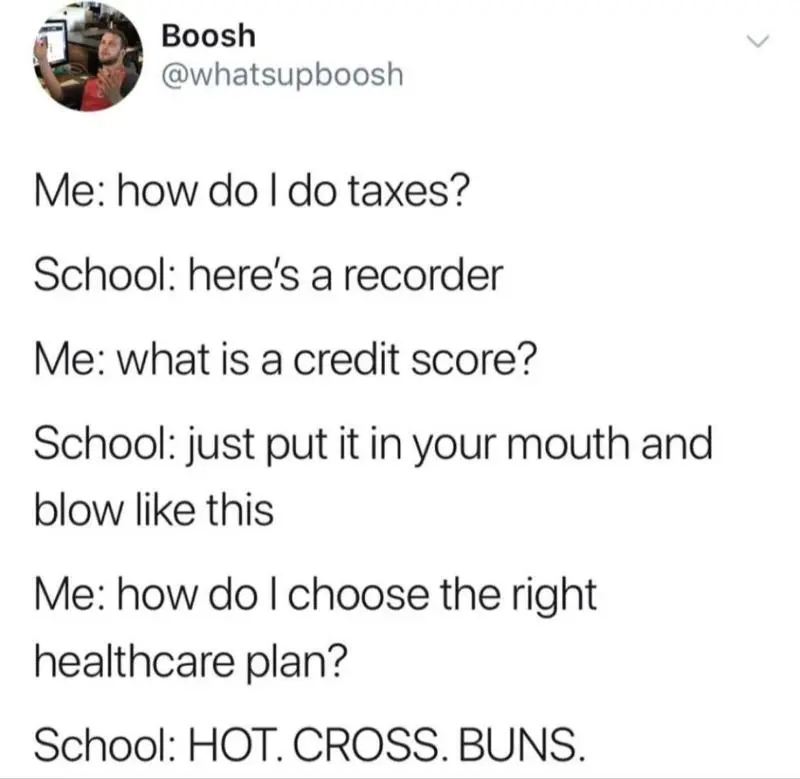

A kid who complains about not learning taxes in school. Would never of paid attention in those classes in school.

It's "would never've" or "would never have". Who wasn't paying attention in class?

Here's the Wikipedia article on linguistic descriptivism

I didn't pay attention to grammer because that's for dorks who use the internet toooooooooooooo much

wow sick burn

WOW THANKS!!!

Being exceedingly pedantic about grammar to "own" somebody you disagree with doesn't make you right, it just makes you an asshole.

This is barely a grammar issue and more of an ignore issue, besides it completely fits the topic this time.

Ingorance of what? Not writing perfectly 100% of the time?

And it doesn't "fit". They're taking a grammatical issue and inflating it to dismiss their point and insult them. Regardless of what mistakes they did or didn't make, everyone knew what they meant. Making it a "gotcha" doesn't accomplish anything useful.

There's genuinely nothing wrong with pointing out grammar in a normal context, it is obviously awful when you dismiss someone's point over it though which they don't do here.

That is literally what they did

The only point of making a comment like that at the end is to dismiss and shame someone for making a mistake.

Helping someone learn is usually helpful, though perhaps not always wanted. Doing so to call them stupid is not.

According to this exact logic the original commenter did the exact same thing but to the original post.

I don't see it that way, but in what way would that matter?

Taxes are just a really long and complicated math worksheet

The IRS gives you a 100 page step-by-step manual, and only requires addition, subtraction, multiplication and (rarely) division. For someone who just has a W-2, you fill out one field for income and do the math for the tax bracket.

And why* can’t we just get a pre-filled tax return and confirm it yes/no?

Because that would hurt the poor b/c only the wealthy would still hire tax experts if tax returns were pre-filled.

Naw, the current system doesn’t hurt the poor at all!

*according to lobbyists like Intuit, maker of TurboTax

I think the bigger issue is that too many of the non-poor are willing to vote against their own interests. Europeans don't hate paying taxes, but they want it to be simple. Americans hate paying taxes, and too many of them can be conned into thinking that it's bad if the government makes it easier.

I was taught the 140ez in school, most kids didn't care.

I was taught budgeting in middle school where they actively taught people 3/4 of your monthly paycheck NEEDS to go to your mortgage.

I thought it was bank propaganda looking back on it.

3/4ths is definitely house poor living. There is some benefit to going as big as you can afford though since moving is a huge pain, buying a bigger better house up front can save a lot of headache and possibly money, but even then staying under 40% seems like a good idea.

The hell you were