this post was submitted on 23 Jan 2025

1174 points (99.1% liked)

Political Memes

7694 readers

3561 users here now

Welcome to politcal memes!

These are our rules:

Be civil

Jokes are okay, but don’t intentionally harass or disturb any member of our community. Sexism, racism and bigotry are not allowed. Good faith argumentation only. No posts discouraging people to vote or shaming people for voting.

No misinformation

Don’t post any intentional misinformation. When asked by mods, provide sources for any claims you make.

Posts should be memes

Random pictures do not qualify as memes. Relevance to politics is required.

No bots, spam or self-promotion

Follow instance rules, ask for your bot to be allowed on this community.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

This is just peak brainworm. What does someone making nearly a million dollars a year even do with an extra 7k?? Make their scroodge McDuck vault a little deeper? Doesn't matter how deep it is, you still can't dive into it like a pool. Idiots.

No, you totally can dive into a pile of gold and swim in it and they should definitely all try it. It works better the higher the diving board is.

they use dollar bills instead of gold coins, you can get a cushy landing and swim through it pretty well.

I hope they get paper cuts on their eyeballs.

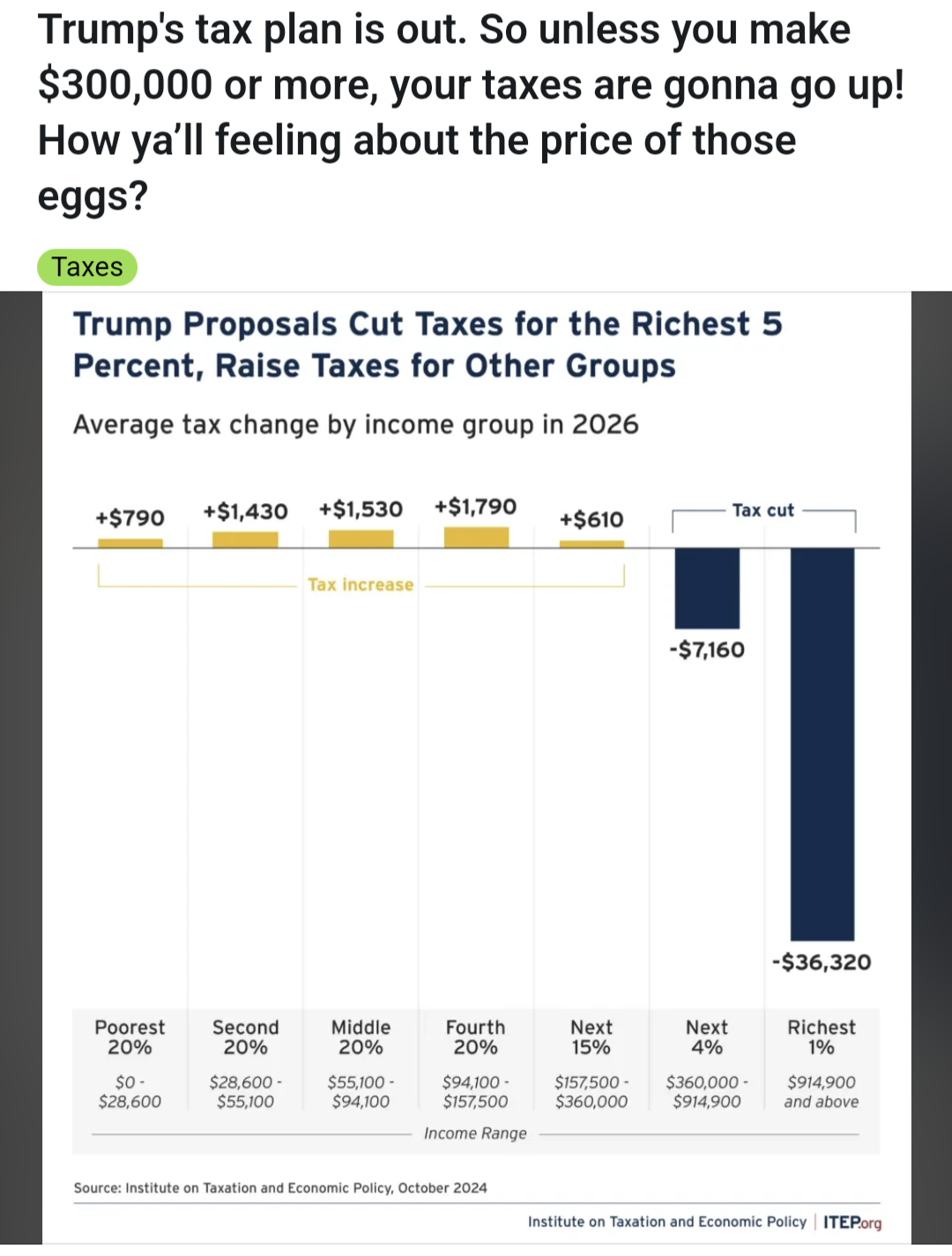

Plus, at the other end of the spectrum, I'm quite sure anyone making $28.6k a year would be very happy to pocket an extra $790.

Supposedly they invest it back into the economy, or, at least that’s what I’ve been told.

Yeah, of course, through stock buybacks and executive bonuses.

Just enjoy being the wind beneath the golden parachutes. 🪂

To be honest, if you're able to make a million a year (even hundreds of thousands a year), you can afford an accountant who will tell you not to take compensation as employment income.

If you're a business owner you'll be taking a significant share as dividends, or if you're an executive you'll be taking stock options or other share based compensation. If done correctly, you can not only take advantage of lower tax rates but also defer taxes to future years.

If you say so....I'm more of a turbotax on April 14 kinda guy

They are alluding to capital gains. If you don’t need money now, you take 50 million dollars in stock, hold it for at least a year, and now you’re paying 15% or less instead of whatever the top tax bracket would be (like 37% or something) if you were to take it as employment income.

One of the greatest unfairnesses in the tax systems in many countries (certainly at least the US and UK) is that income from "investment" (which generally is money made from having money or owning thing, though there are often ways for freelancers and small business owners to use it to have their income from work look like the income of business ownership) is taxed less than income from work.

It's "interesting" how the countries with the loudest "strives vs skivers" and "meritocracy" bullshit from politicians, generally penalised people more for working than for sitting on their hands whilst their fortune naturally grows through rent-seeking.

Pretend that's the end of the bracket and it doesn't increase from there. Now the guy making 100,000,000 gets an extra $700,000