this post was submitted on 30 Dec 2024

1283 points (98.6% liked)

Microblog Memes

6080 readers

407 users here now

A place to share screenshots of Microblog posts, whether from Mastodon, tumblr, ~~Twitter~~ X, KBin, Threads or elsewhere.

Created as an evolution of White People Twitter and other tweet-capture subreddits.

Rules:

- Please put at least one word relevant to the post in the post title.

- Be nice.

- No advertising, brand promotion or guerilla marketing.

- Posters are encouraged to link to the toot or tweet etc in the description of posts.

Related communities:

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

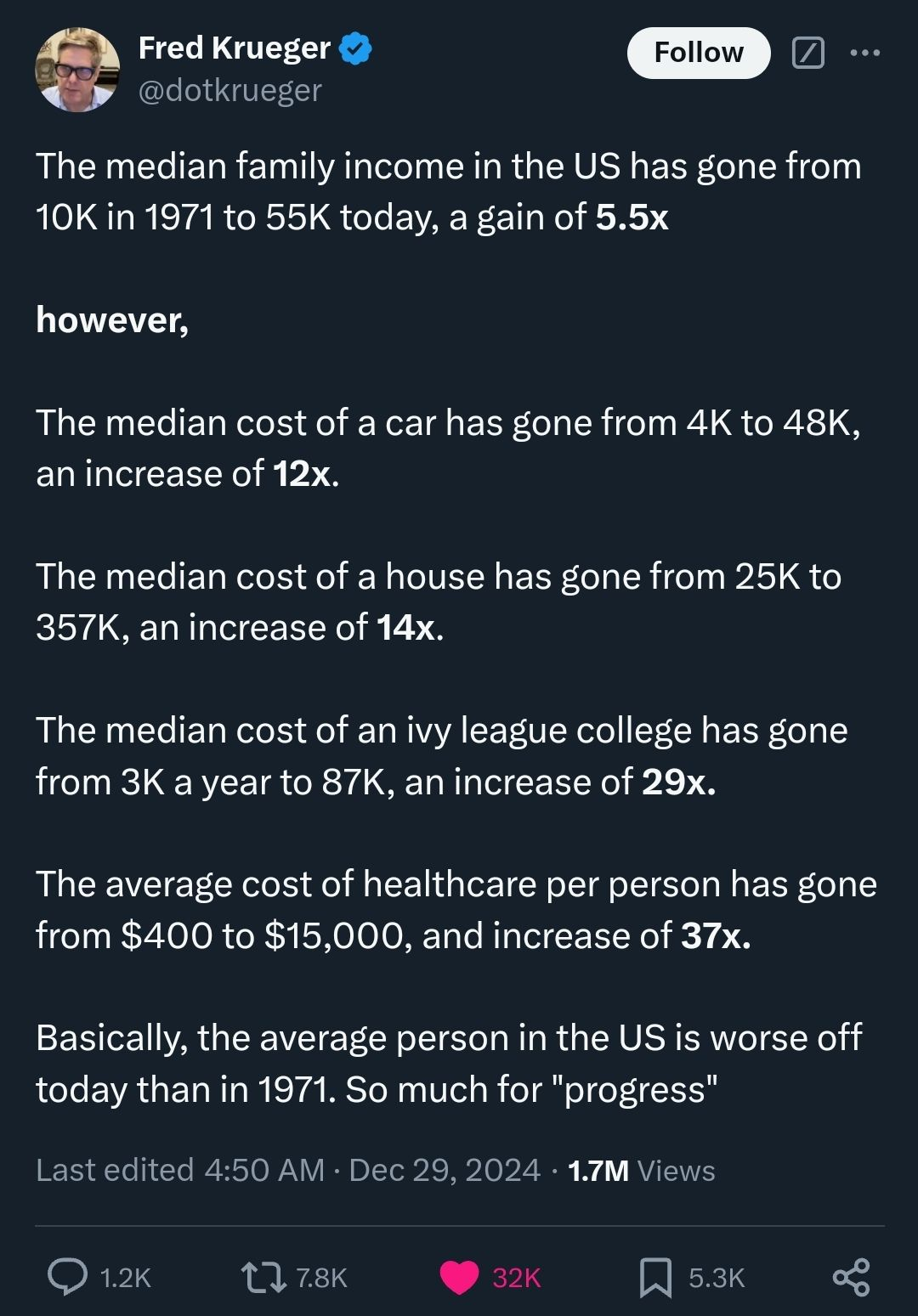

Yeah, this kind of comparison really drives it home. The inflation figures, while not cooked in some grand conspiracy sense, really completely fail to capture the real price increases experienced by real people.

The limitation of CPI is that it is designed for one specific thing, but we end up using it for others. If you want to measure the value of a commodity over time, like a bushel of wheat or a barrel of oil, CPI is OK for that. A bushel of wheat or a barrel of oil now are pretty similar to ones in 1970. But most goods we purchase are not so directly comparable. The CPI calculation tries to compare like goods to like goods, and it applies adjustment factors to the price of goods that aren't constant through time. For example, the TV you can get in 2024 is far, far better than one you could get in 1970. In CPI terms, this means that the real cost of TVs has plummeted by orders of magnitude.

But it goes beyond electronics. Think of homes. People will wring their hands and decry Americans as greedy by citing the size of new homes today vs in 1970, as they have significantly increased. But it's not a matter of greed; you simply cannot buy a new 1200 ft^2 modest home in post places in the country today. They don't make them anymore. Zoning has so restricted housing construction that all new housing has to be luxury housing. Yes, if you actually could find a duplicate of some c. 1970 1200 ft^2 home built new today, it would likely be quite affordable. But in terms of both size and construction details, it's not legal to build homes like that anymore. But this won't show up in the inflation figure. They'll compare the 1200 ft^2 entry-level home in 1970 to whatever rare example of that they can find that is built today of someone building one of those in unzoned farmland in rural North Dakota, and conclude that house prices haven't risen so much. In reality, no one can actually find those homes near job centers.

Or consider college. The college experience of 2024 is vastly different from that of 1970. The MBA class wormed their way into university administration and kicked all the actual academics out of admin. The MBA class see the kids as "customers" rather than pupils or students. And all the colleges and universities, even the state ones, went into MBA customer-seeking overdrive. Colleges have been luxurified. Big fancy dorms, extravagant student unions and study spaces, decadent gym facilities, etc. College at a state school in 1970 was 4 people crowded in a tiny dorm room, where your 'gym' was the campus running track. CPI looks at what it would cost to run a 1970s-style university in 2024, and concludes that college hasn't gone up in price as much as it has. This is one reason community colleges have remained so relatively affordable. By their nature, they deal mostly with commuter students who wouldn't want to use your stupid fancy gym even if you built one.

And the same thing for vehicles. Automakers have chased higher and higher rates of return by making bigger and heavier vehicles. Yes, if you could find a car made today that was an exact duplicate of a 1970s vehicle, it wouldn't have inflated as much. And that's what CPI shows. But it doesn't capture the actual buying options Americans have at their fingertips.

Ultimately, here is what you are doing when you use an inflation calculator and put in 10,000 in 1970 and calculate to today. You are fundamentally saying, "consider the kinds of goods and services average people bought in 1970. If I bought that exact same basket of goods, literal exact duplicates, what would they cost today?"

And for economists, that kind of analysis is useful. If you want to calculate interest rates and GDP growth, CPI works great for that. But for real people in the real world, they cannot simply live like it's still 1970. The affordable options they had then simply no longer exist in the market. Sometimes things have changed for good reasons like product safety, but more often it is simply because the MBA class has turned everything into a luxury good to maximize return on investment. Everything has become a luxury good aimed at the top 20% of earners. And our policy tools for dealing with inflation have been utterly unprepared for this.

Another limitation of CPI is that it does not account for the devaluation of a currency due to the increase in circulating currency supply which is something the price of gold does perfectly. We can also put the rise in the price of gold next to a chart showing the increase in us circulating currency and they are very close to each other.

The price of gold was constant, only fluctuating 80% from $19 to $35 in the first 172 years of the us dollar’s history. Then nixon ended the gold standard in 1972 and within 8 years the price of gold increased 2000% from $35 to just under $800 one year later the us printed its first one trillion in circulating currency now we print 1 trillion every 3-4 months and the price of gold has increased 7500% since nixon withdrew from the bretton woods agreement. In 1956 minimum wage of $1/hr equaled 60 ounces of gold annually ($160,000 today) in 1968 it was $1.60 which is $250,000 in todays money. Gold has alwaus been considered an inflation proof asset, it has retained its value for all of history. An ounce of gold will always be able to purchase a fine set of garments, liek a really nice 3 piexe suit with undergarments, a button shirt and tie and leather shoes, a months rent in a 2 bedroom in a nice part of town or between 300-400 loaves of good bread from a bakery.

But cue in the “economics experts” telling me the price of gold has nothing to do with the value of currency