this post was submitted on 28 Aug 2024

377 points (98.0% liked)

YUROP

2259 readers

4 users here now

A laid back community for good news, pictures and general discussions among people living in Europe.

Topics that should not be discussed here:

- European news: [email protected]

- European politics: [email protected]

- Ukraine war: [email protected]

Other European communities

Other casual communities:

Language communities

Cities

Countries

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- https://feddit.dk/

- [email protected] / [email protected]

- [email protected]

- https://lemmy.eus/

- [email protected]

- [email protected]

- https://foros.fediverso.gal/

- [email protected]

- [email protected]

- Italy: [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- Poland: [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

- [email protected]

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

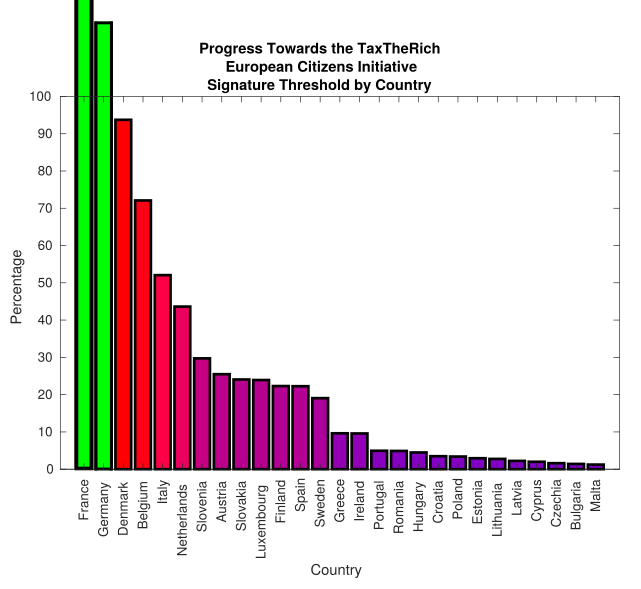

From https://www.tax-the-rich.eu/home#info

What a bad initiative. This would basically guarantee that people in Europe can't ever retire on a modest income.

1.25 million euros per person on top of your main home doesn't allow you to retire?

It's probably not so much you can't retire, but you can't retire with an income that you'll be comfortable on.

A brief look suggests the average pre-tax wage in Belgium is around €3800, or about €45000 per year. Assuming you already own your home, or continue to pay mortgage payments at the same rate as before retirement, your pension needs to roughly match your income to not have a drop in living standards. A €1250000 pension pot will buy an annuity that pays a bit more than that, probably around €55000 a year, but assuming you amassed that in your pension pot you would probably have been on a higher than average salary, so it's going to be close, and an annuity at that level wont increase with inflation, so your buying power drops over time, just when you're more likely to need a care home or nursing support.

Belgium has public pensions with a minimum of €1,549 per month (https://www.brusselstimes.com/344282/monthly-pension-in-belgium-to-top-e1500)

You seem to assume that 1.25 millions is supposed to be your only income, but that's not the case.

A really rough calculation (and I acknowledge I could be somewhat off here) suggests that if you contribute for 40 years, and get around 5% interest per year, you'd need to put in an average of €10,000 per year to reach €1,250,000. Working out average salary progression through a working life is left as an exercise for the interested reader, but assuming you're putting 10% of your salary into your pension, you'd need to be earning six figures to make that pension pot, so a drop to around €73,000 including the public pension could be hard to manage.

As I said, not so much can't retire, as can't retire at the same standard of living, especially as annuity payments wouldn't increase with inflation.

This just qualifies as ultra-rich - which is not wrong, imho. I don't know the exact conditions for Belgium but in Germany the taxes would start to show effect at 4,6 million with 2%. If you think about it assets in this magnitude could easily lead to 1000€ daily passive income. Those 2% wont hurt.

But it doesn’t include the home or business assets. So you could have one guy with €1.25 million in stocks who lives off a modest income from dividends and sleeps in an RV and he would be classified as ultra rich.

Another guy could live in a €2 million mansion and be the owner of a €100 million business (but have no other investments) and be classified as NOT ultra rich. See the problem?

Yeah, the problem is you're shooting down a great initiative with an edge cases that affects maybe a couple dozen RV sleeping millionaires. Maybe he should participate and contribute to society!

Edge cases are what these guys used to get their fortunes in the first place. The more common term for these is tax loopholes! Everyone knows that big corporations like Apple use them (“Double Irish” being the most infamous) but individuals use them all the time.

Anyway, the point I’m making is that I really don’t care about the RV sleeping millionaire, I care about taxing the 200 millionaire business owner I mentioned who would currently be exempt. Because of the loophole, you can bet that all of the “ultra-rich” are going to restructure their investments into a single business they own so that they can completely exempt themselves from the tax.

Yeah, start with this law then close loopholes. It's like you're climbing a cliff, you don't leap straight to the top you get handholds where you can find them and make your way up.

Why should someone be able to live off dividends if they have “ultra-rich” wealth at the bank? This person has a lot of money so if they live in an RV it’s obviously a choice they made.

Plus they could just spend some of that stock money and go below “ultra rich” level and get taxed less. And perhaps then they have to use part of their non-ultra-rich wealth to live their RV dream life to supplement their dividends. Doesn’t sound too bad.

TLDR; I don’t feel bad for someone that can’t live dividends when hey have more than one million euro in the bank.

Edit: while is still stand by comment, I do see I missed your point about fairness. Not too big of a problem in my mind. Or perhaps a solution would be to tax home values above X amount? (Edit2: and only the amount above X)

Reposting my comment below because it seems people aren't aware of this

Belgium has public pensions with a minimum of €1,549 per month (https://www.brusselstimes.com/344282/monthly-pension-in-belgium-to-top-e1500)

You seem to assume that 1.25 millions is supposed to be your only income, but that’s not the case.