this post was submitted on 14 Aug 2024

1896 points (99.5% liked)

People Twitter

5959 readers

1762 users here now

People tweeting stuff. We allow tweets from anyone.

RULES:

- Mark NSFW content.

- No doxxing people.

- Must be a pic of the tweet or similar. No direct links to the tweet.

- No bullying or international politcs

- Be excellent to each other.

- Provide an archived link to the tweet (or similar) being shown if it's a major figure or a politician.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

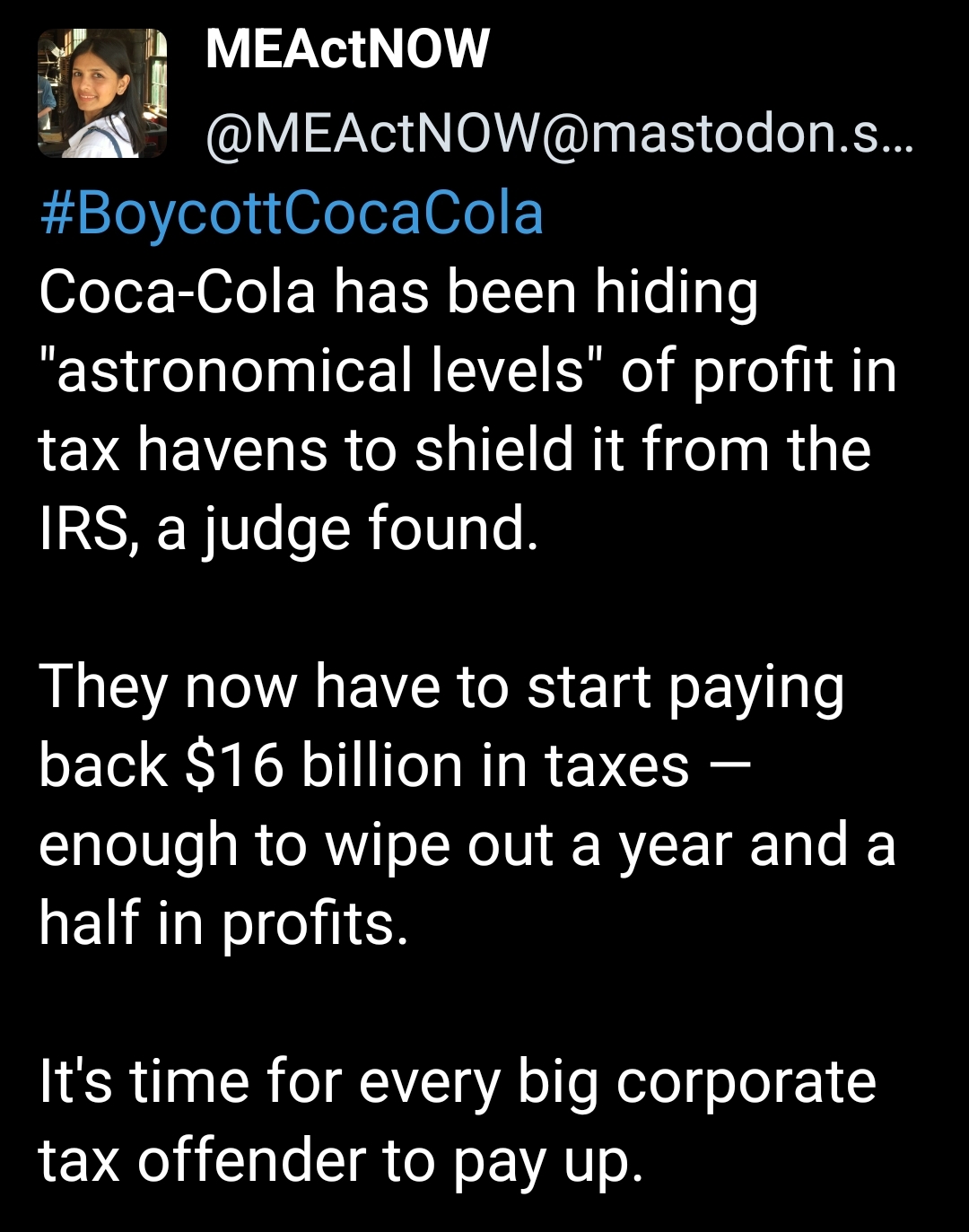

So you're kinda right and kinda not.

Roughly what actually happens in cases of massive back-taxes likes this is that the movement of funds is tracked back through to the municipalities where they initially failed to pay. From there the actual unpaid amounts are calculated for each level, then priority weighting is assigned (if the total sum was reduced to less than the delinquent payment), then the repayment schedule is calculated for each municipality, and finally the IRS takes the cost of remediation investigation from the top (probably about 1.5 mil for this one) and begins repayment.

That 'repayment schedule' means that the funds not immediately disbursed can be loaned out (most often to other government agencies) (there's a term for the specific kind of loan this is, it's very short term but I am totally blanking on the name). Funds are usually given out at the next funding cycle unless there's a claim made for immediate funding, and from there it's just folded into the budget and assigned however that municipality / organization handles budget allocation.

TL;DR: Biden admin can't have the funds directly except in emergencies, that would be constitutional overstep. It just goes back to the government at the next budget assignment. Which you can draw your own conclusions about where Congress will put that additional money.