I'm not sure about tracking your spending, but I can tell you that you're grocery shopping is way too wasteful. That's like $200/week on groceries for one person. Unless you have a very limited diet, you're paying more than double what you should be at the grocery store. For context, when I get groceries for me and my wife, I rarely spend over $50. Get store brands, buy bigger sizes, and shop at cheaper stores like Aldi. Stop buying frozen and processed garbage; buy fresh meat and vegetables and cook big batches and have leftovers. This time of year is great for a big pot of soup/chili!

I think if I were interested in tracking spending like that, I might just build a simple spreadsheet with dates and costs, maybe add variables for the unusual things like stocking up to have guests to feed or whatever. Sorry I can't be more helpful on that front. If you're not experienced with cooking, there are some really good YouTube channels that can teach you some good, versatile recipes that are very budget-friendly.

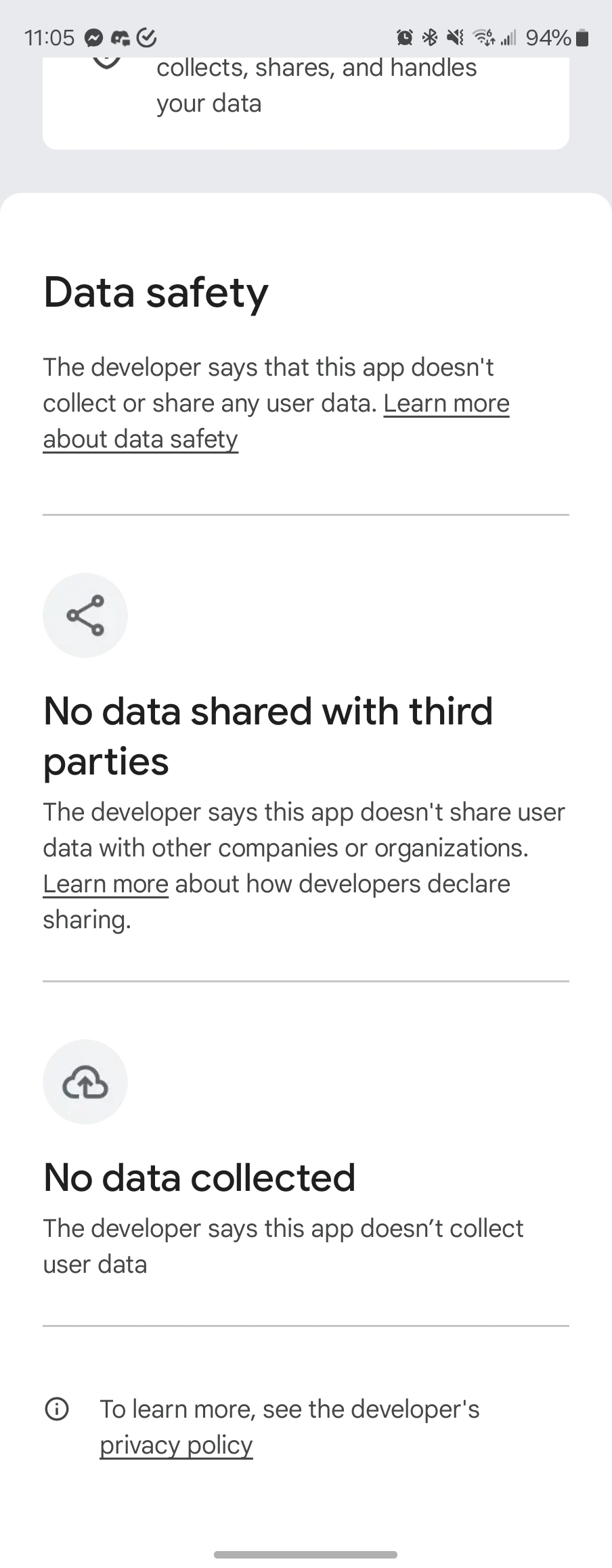

Always nice to see

Always nice to see