TLDR ? Much more FTD than other stocks ?

DRS Your GME

ΔΡΣ Central

Community to discuss the DRSGME.org project and resources, and how to spread DRS advocacy and information to GameStop investors around the world.

Have a great idea to spread the word? There are some resources here to get started!

https://www.drsgme.org/free-resources

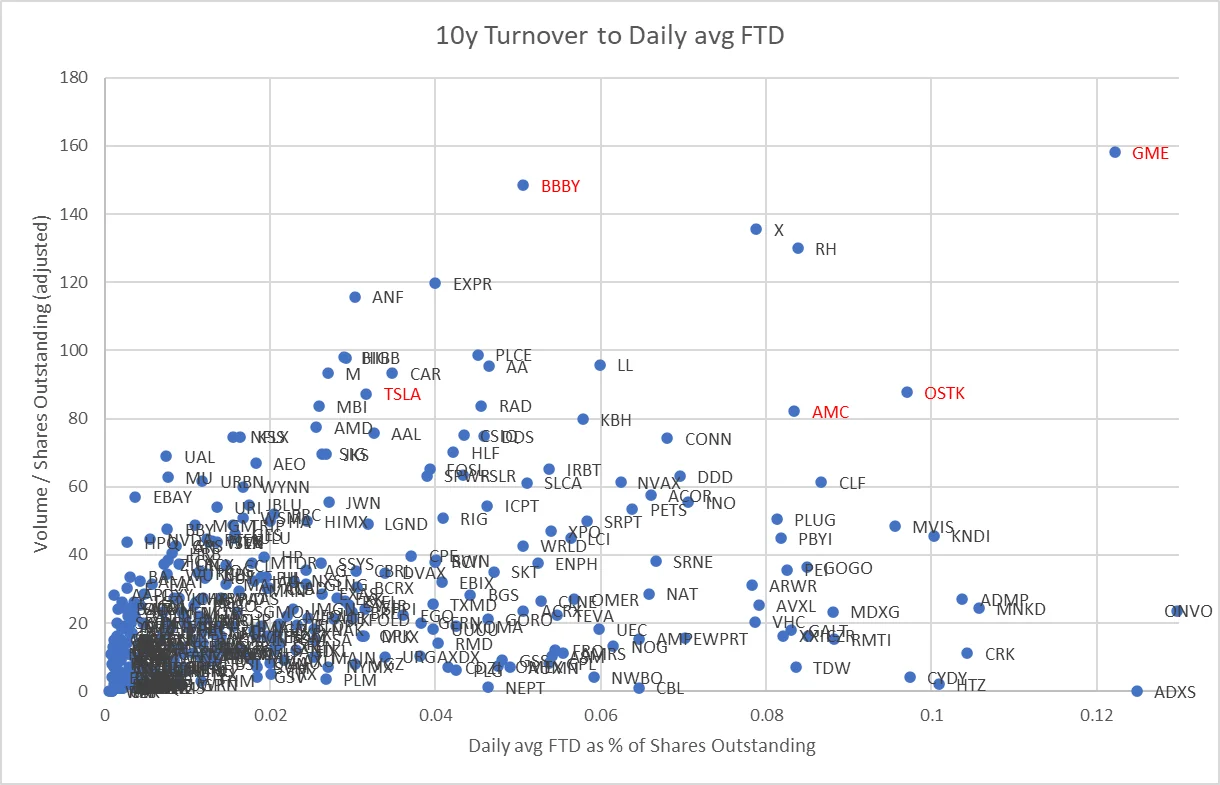

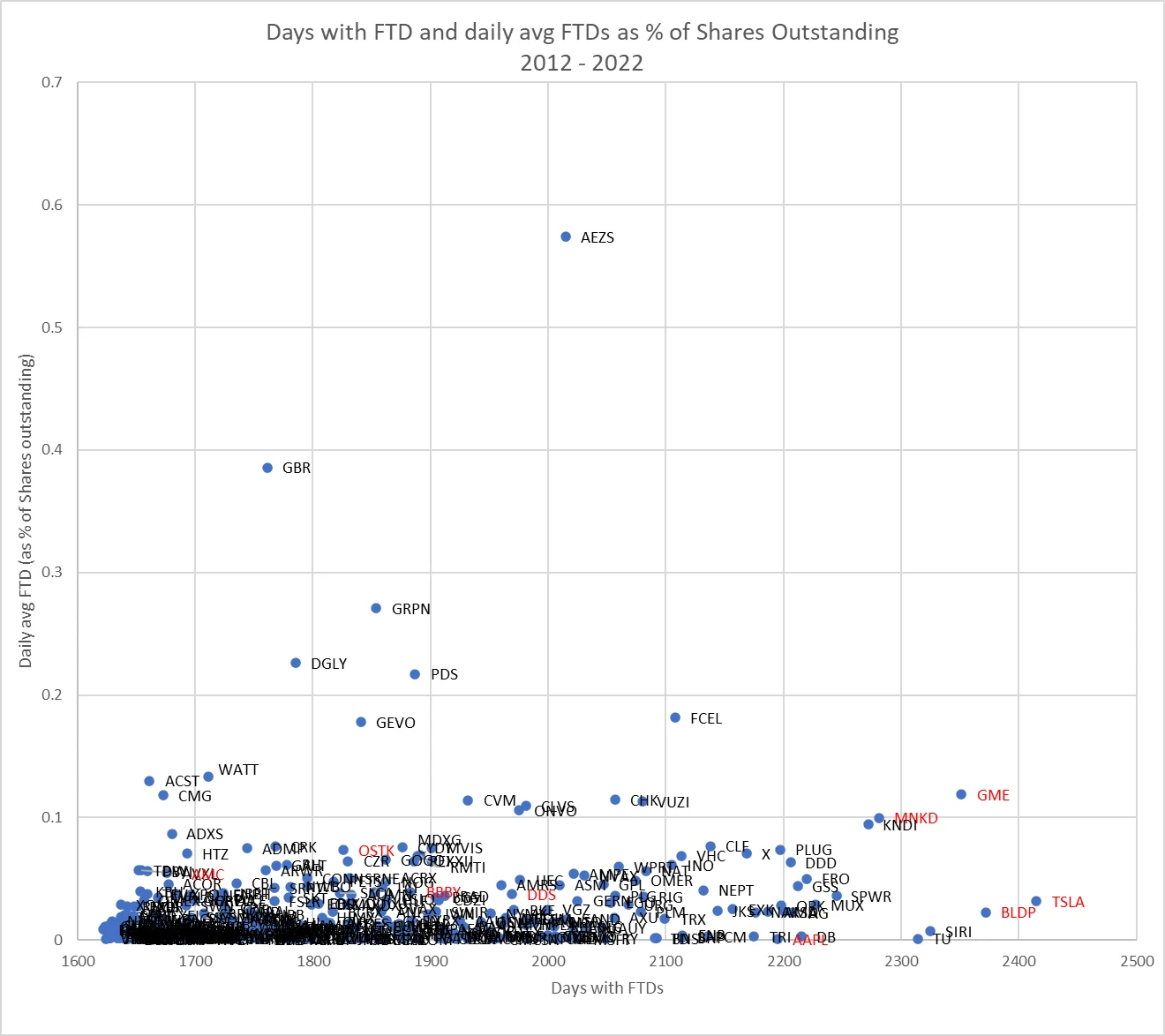

GME is certainly an outlier over 10y. One of a few. If one looks in specific years GME looks rather normal in this group of 300-400 outliers.

So, yes, GME is probably sold many times the outstanding shares, but so are a lot of other stocks, too.

Though, not many have RC.

Great work! What does 10 years mean, is it total volume over 10 years and average daily FTD in the same period? Did GME become an outlier during the sneeze or was it already 10 years ago?

Thank you. Yes total volume for 10y and avg daily FTD for the same period. A very good question! See:

- https://www.reddit.com/r/Superstonk/comments/wursjt/gme_outstanding_shares_turnover_compared_to_msft/

- https://www.reddit.com/r/Superstonk/comments/wlrdlk/previous_research_found_that_tsla_and_bdlp_had/

Indeed GME was always on the top, but became the outlier during the sneeze in terms of volume. If I would redo the graph I think BBBY would have a similar position.