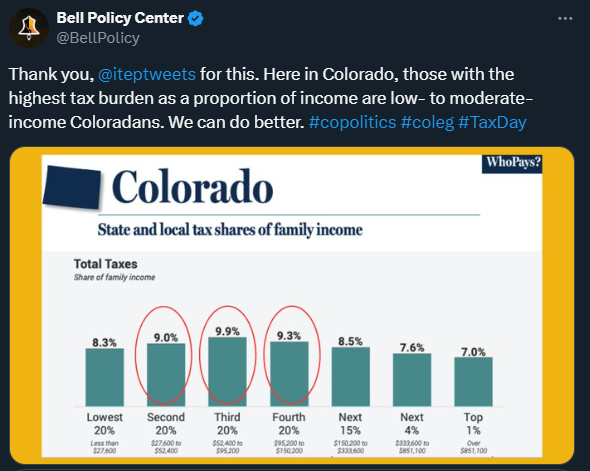

Edit: I have since realized that I am unsure on the calculation of tax burden is calculated for the chart.

I am skeptical of the representation of the data. My sense for ways to skew data is set off when making statements of segments of population when the segments are not comparable.

I would need a better understanding of the calculation of the values reported to be able to justify that the top 20% are split into smaller groups than they’re being compared to.