this post was submitted on 04 Apr 2024

1021 points (98.8% liked)

linuxmemes

24633 readers

769 users here now

Hint: :q!

Sister communities:

Community rules (click to expand)

1. Follow the site-wide rules

- Instance-wide TOS: https://legal.lemmy.world/tos/

- Lemmy code of conduct: https://join-lemmy.org/docs/code_of_conduct.html

2. Be civil

- Understand the difference between a joke and an insult.

- Do not harrass or attack users for any reason. This includes using blanket terms, like "every user of thing".

- Don't get baited into back-and-forth insults. We are not animals.

- Leave remarks of "peasantry" to the PCMR community. If you dislike an OS/service/application, attack the thing you dislike, not the individuals who use it. Some people may not have a choice.

- Bigotry will not be tolerated.

3. Post Linux-related content

- Including Unix and BSD.

- Non-Linux content is acceptable as long as it makes a reference to Linux. For example, the poorly made mockery of

sudoin Windows. - No porn, no politics, no trolling or ragebaiting.

4. No recent reposts

- Everybody uses Arch btw, can't quit Vim, <loves/tolerates/hates> systemd, and wants to interject for a moment. You can stop now.

5. 🇬🇧 Language/язык/Sprache

- This is primarily an English-speaking community. 🇬🇧🇦🇺🇺🇸

- Comments written in other languages are allowed.

- The substance of a post should be comprehensible for people who only speak English.

- Titles and post bodies written in other languages will be allowed, but only as long as the above rule is observed.

6. (NEW!) Regarding public figures

We all have our opinions, and certain public figures can be divisive. Keep in mind that this is a community for memes and light-hearted fun, not for airing grievances or leveling accusations. - Keep discussions polite and free of disparagement.

- We are never in possession of all of the facts. Defamatory comments will not be tolerated.

- Discussions that get too heated will be locked and offending comments removed.

Please report posts and comments that break these rules!

Important: never execute code or follow advice that you don't understand or can't verify, especially here. The word of the day is credibility. This is a meme community -- even the most helpful comments might just be shitposts that can damage your system. Be aware, be smart, don't remove France.

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

Web browsers.

Edit: Nevermind, I don't know what this even is.

At least in the EU web browsers don't allow for authenticating transactions (beyond a limit of e.g. 30€). Either an additional authenticator app or a standalone card reader is mandatory.

Luckily my banking apps work flawlessly on GrapheneOS and even microG, likely because of they care about the bootloader being locked again.

I guess I don't know what you mean by "authenticating transactions".

Online transactions require a second factor which displays the actual amount to be transferred. This works by either an app which receives the transaction data (recipient, how much) over the network, or a device which takes the bank card and is used to scan something similar to a qr code. The device then displays the transaction data.

This makes sure a fraudulent site can't easily change the amount or the recipient of a transaction, even if they somehow made an identical website (or close enough).

https://www.ecb.europa.eu/press/intro/mip-online/2018/html/1803_revisedpsd.en.html

It's not perfect, especially with people using a banking app and the second factor app on the same device for convenience sake.

Interesting. If they do that in the US some day, I would absolutely much rather buy that device than unroot my phone.

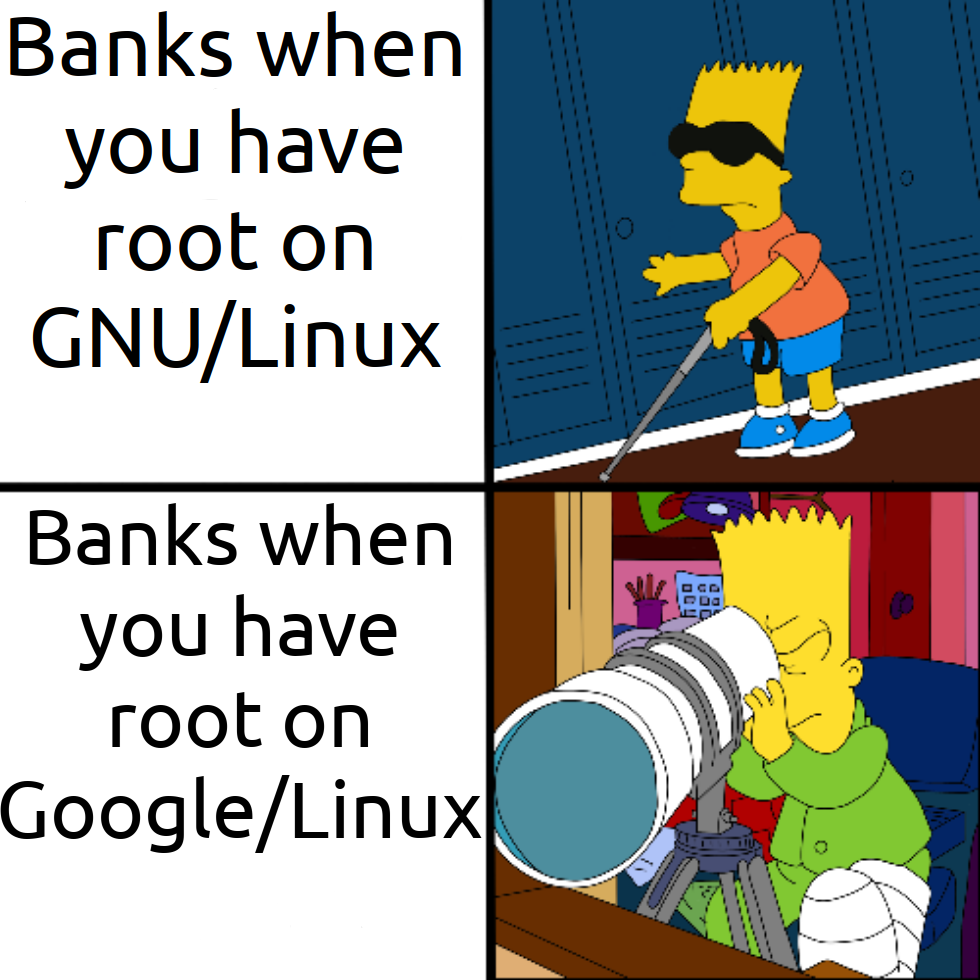

Not for authentication. No idea if this is not a thing, but banks here in Germany all have their weird proprietary TOTP app that checks if your device is rooted or now even if it is a "Google certified OS".

You can use some weird hardware device instead with the obvious drawbacks.

My favorite thing is when banks don't allow passwords that have spaces in them or are more than 12 characters long.

Honestly there should be a standard of what security means, like how passwords are stored and how TOTP is implemented, and if a bank doesn't implement it then THEY are responsible for any "identity theft" that happens on their site, not the users.

Looking at you, fucking Paypal.

Or yes, my bank wanting only numbers not even letters.

Literally the only passwords I dont have in Firefox.

But don't support standards like WebAuthn or even FIDO 2.