this post was submitted on 18 Oct 2023

293 points (96.8% liked)

Personal Finance

4380 readers

8 users here now

Learn about budgeting, saving, getting out of debt, credit, investing, and retirement planning. Join our community, read the PF Wiki, and get on top of your finances!

Note: This community is not region centric, so if you are posting anything specific to a certain region, kindly specify that in the title (something like [USA], [EU], [AUS] etc.)

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

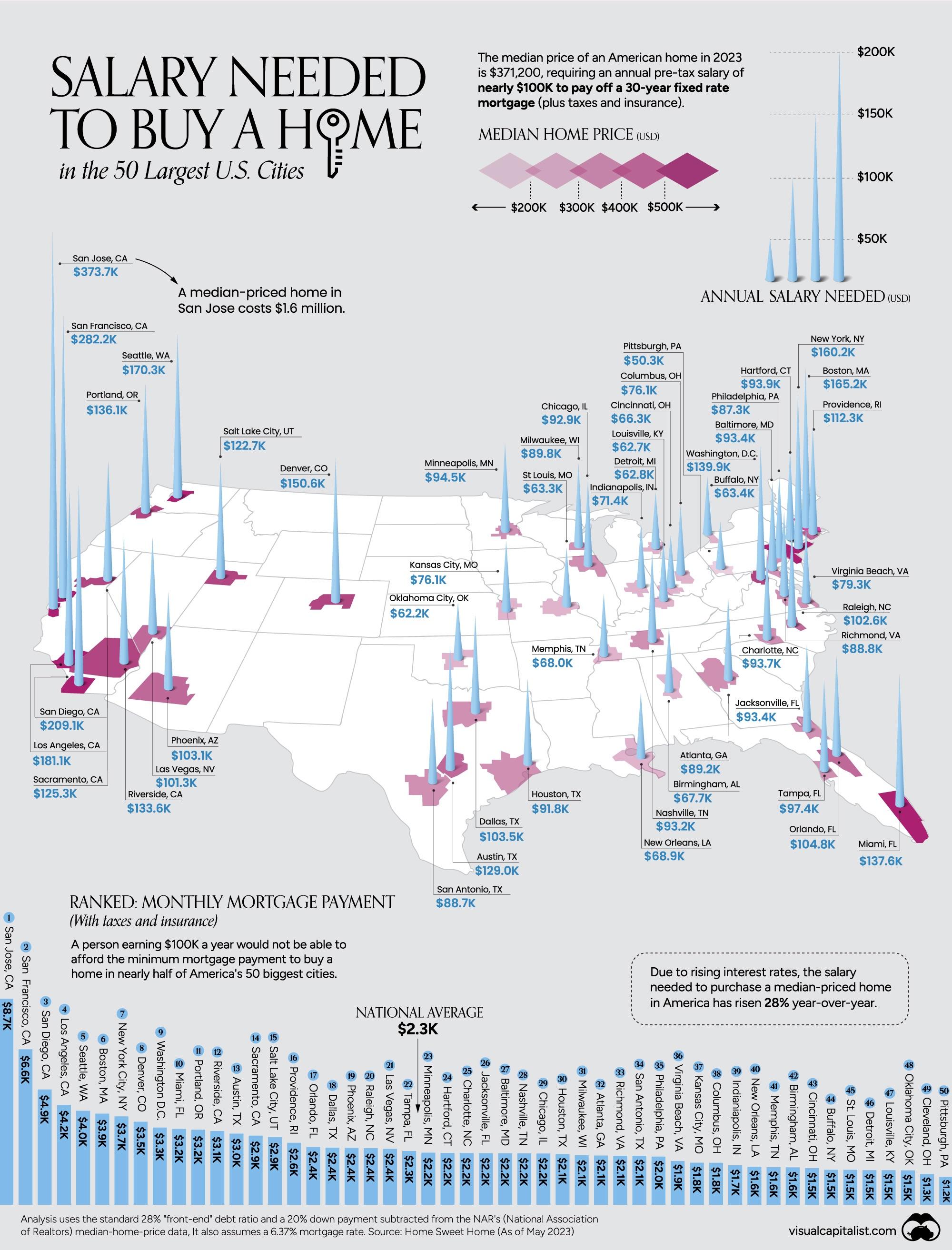

They should include the interest rate they are using to calculate the mortgage. Based on what's provided they are assuming around a 6% mortgage which is no longer available. Tack an extra $1,000 monthly payment onto that million dollar home and an extra $40,000 to your income to make it affordable. (Assuming debt/income ratio and income taxes)

Did I miss anything?

They did it’s at the bottom. 6.37%

Which, having literally just bought a home, is a supremely optimistic rate to get right now. We spent $10k buying down our interest and only managed 6.9%