this post was submitted on 14 Jan 2025

143 points (96.1% liked)

Privacy

32742 readers

2674 users here now

A place to discuss privacy and freedom in the digital world.

Privacy has become a very important issue in modern society, with companies and governments constantly abusing their power, more and more people are waking up to the importance of digital privacy.

In this community everyone is welcome to post links and discuss topics related to privacy.

Some Rules

- Posting a link to a website containing tracking isn't great, if contents of the website are behind a paywall maybe copy them into the post

- Don't promote proprietary software

- Try to keep things on topic

- If you have a question, please try searching for previous discussions, maybe it has already been answered

- Reposts are fine, but should have at least a couple of weeks in between so that the post can reach a new audience

- Be nice :)

Related communities

much thanks to @gary_host_laptop for the logo design :)

founded 5 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

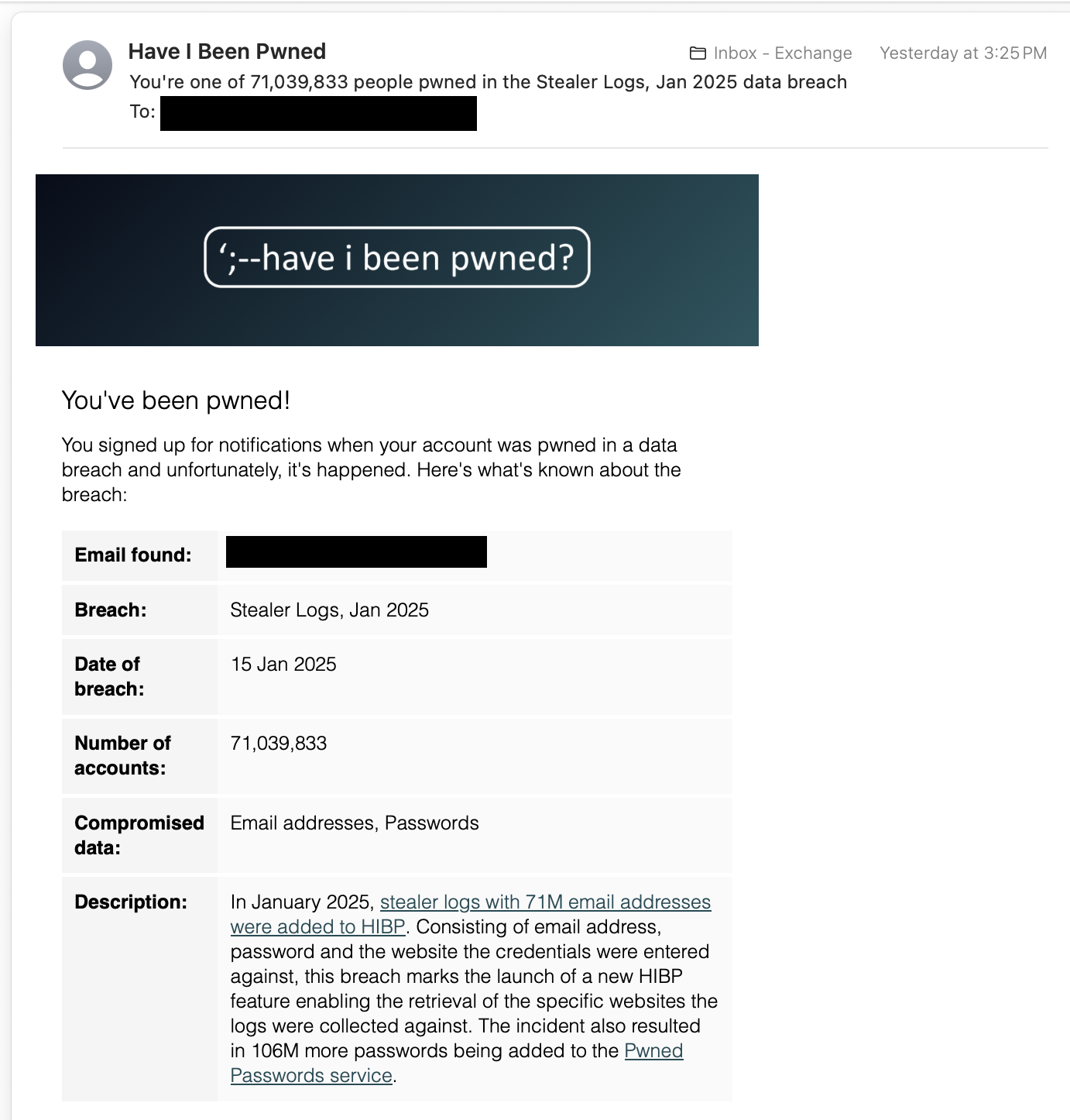

That's unfortunate.

Another thing you can do is to keep available funds on whatever card you use online low. If there's only 1 to 2k on the card, yes it'll suck, but it won't be as impactfull as your life savings.

You a might also consider credit card with a small limit (1k or less) and set auto pay to "pay full balance" every month. Avoid interest like the plague, (those cards have insane interest rates over 20%), but if you're always paying it off in full, there's no interest to pay. If I can't pay the credit card off in full (and I mean the full limit) when I "swipe" it, I pretend it does not exist. None of the "I get played next week, so I can pay it off then" - nope, don't go there.

Supposedly credit cards have better fraud protection than a debit, but maybe that's just another one of our many "Freedom" problems.

The main thing is you're separating the random websites from the majority of your funds to limit how much can be taken. If there's a problem, I'm dealing with Privacy.com and a couple hundred bucks and can still pay the bills. I'm not trying to convince ebayclone#71 and my bank I didn't place an order for 10000 waffle makers before the lights shut off.

And of course, I'm just some rando on the internet, not an actual expert. Not even in same country as you, so take that for what it is.

I wouldn't recommend keeping credit card limits low to only mitigate fraud risk - credit card companies generally will take the hit for unauthorized use, aka stolen information, and send you a new card. So keeping the limit low in an effort to make sure that if your info is stolen they'll only be able to steal $1000 or $2000 isn't really necessary, and only affects your ability to use credit and have a better credit score (because your % of utilization of your overall credit limit goes into your FICO).

Instead, review your purchases monthly and inform the card company of charges you didn't make as soon as you see them.

DEBIT cards are a different story. They're a direct link to your bank account funds and there's no intermediary that is willing to take a hit, it's your bank vs you, so if your debit card info (and pin) are exposed you're much more vulnerable. So I wouldn't recommend EVER using debit these days, there's zero reason to, but if you have to then your advice in your OP is more appropriate.

1k or 2k? Lol, my debit cards only have $20 at a time on them at max.