this post was submitted on 04 Sep 2024

8 points (75.0% liked)

Investing

791 readers

3 users here now

A community for discussing investing news.

Rules:

- No bigotry: Including racism, sexism, homophobia, transphobia, or xenophobia. Code of Conduct.

- Be respectful. Everyone should feel welcome here.

- No NSFW content.

- No Ads / Spamming.

- Be thoughtful and helpful: even with ‘stupid’ questions. The world won’t be made better or worse by snarky comments schooling naive newcomers on Lemmy.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

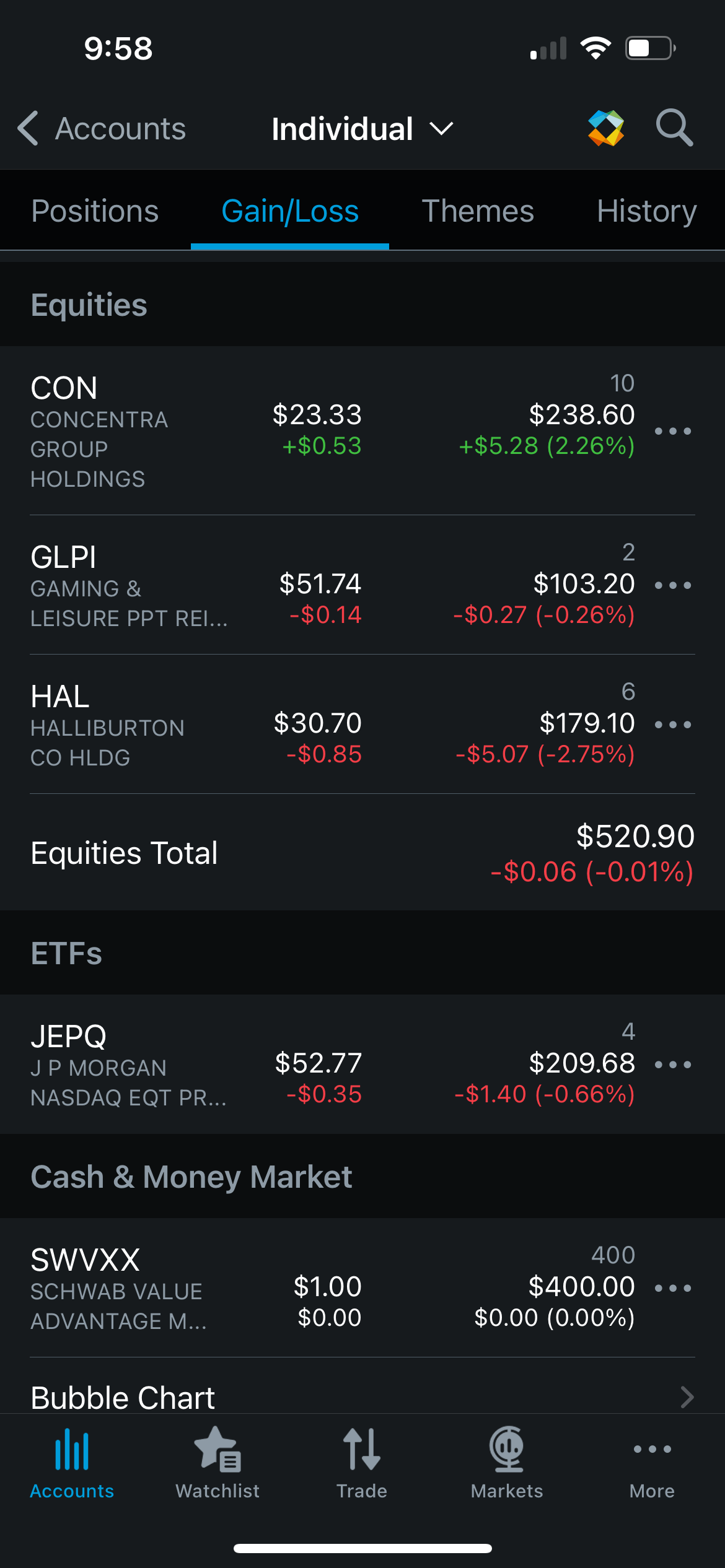

You have way too high a percent of your portfolio in individual stocks. Focus on low fee etfs, ideally ones that track whole or at least broad market segments.

Would you recommend any etf? Is JEPQ not quality?

VWCE and chill is what I do.

Not bad ,pretty tech heavy or solely tech anyway. Not a bad thing but I like to spread out a little in case something goes south in one sector.

Eh? 27% is tech heavy for VWCE but jepq says they are 41% into tech.

From the data sheets I am seeing VWCE is more spread out as it follows international FTSE index while JEPQ only tracks US stocks.

0.35% is a little high for an expense ratio, especially for a product that has basically followed the S&P500 for the last 10 years. I'm no expert, but there are lower fee etfs from Vanguard that perform basically the same.