this post was submitted on 08 Jul 2024

668 points (97.0% liked)

2meirl4meirl

941 readers

175 users here now

Memes that are too meirl for /c/meirl.

Rules:

-

Respect the community. If you're not into self-deprecating/dark/suicidal humor then this place isn't for you. Kindly just block and move on. This is just how some of us cope.

-

Respect one another.

-

All titles must begin with 2meirl4meirl. This is for multiple reasons. One is just so you can be lazy with titles but another is so people who aren't into this kind of humor can avoid it.

-

Otherwise just the general no bigotry, no dickishness, no spam, no malice, etc stuff.

Sidebar will be updated when I feel like and considering I'm Sadboi extraordinaire we'll see when that will be.

founded 11 months ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

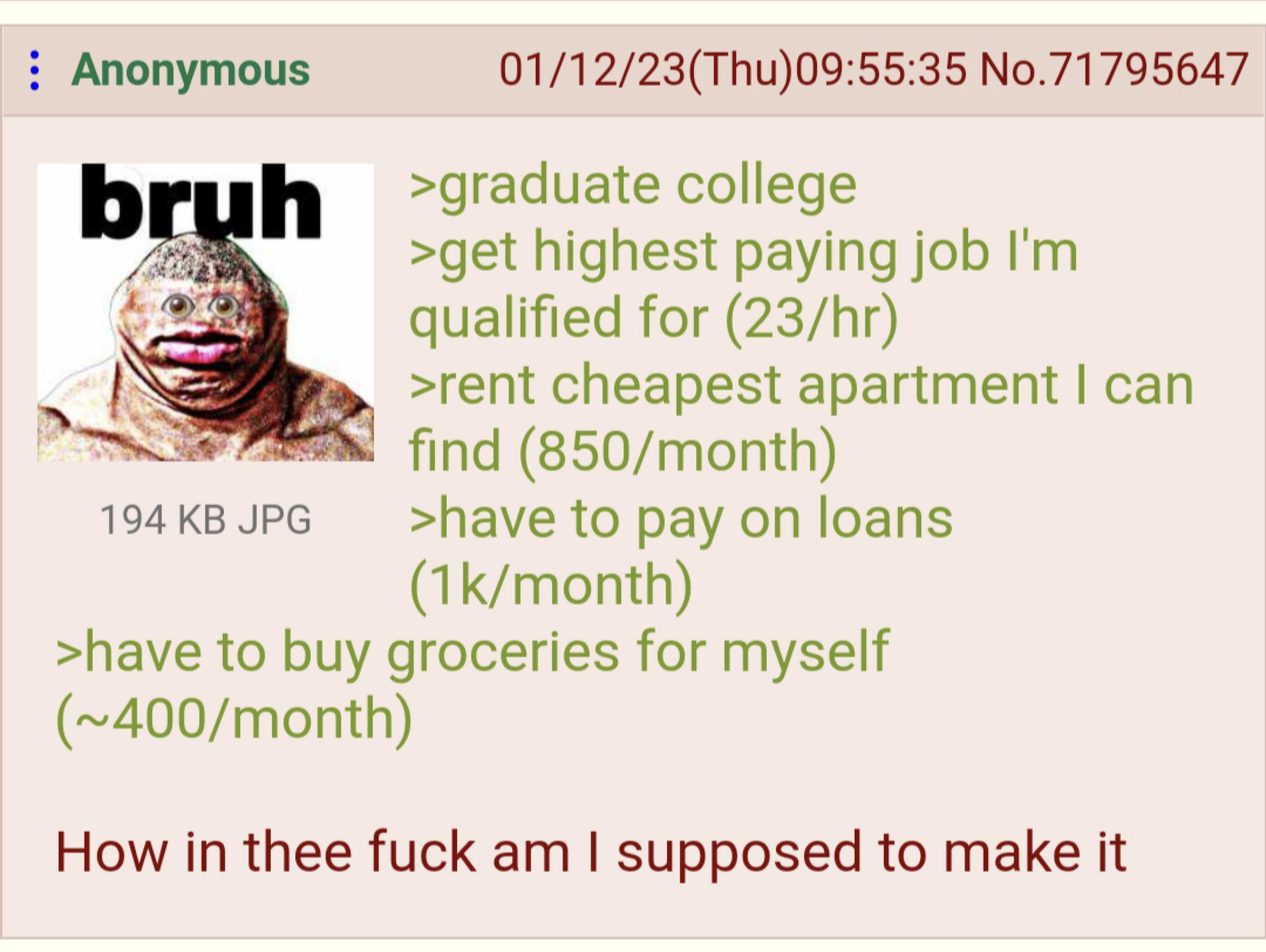

Use this tax calculator; it includes FICA, state taxes, and local taxes:

https://smartasset.com/taxes/income-taxes

No one is paying 40% total tax rate unless they are single, make $350,000+, and live in a high tax area (NYC, San Francisco). If you are married, you have to make at least $800,000 to pay 40% overall.

That's what I used. Still some question about how much nontaxable retirement/Healthcare as well as what the state taxes would be. I estimated $5,700 in federal and $1000 in state. Based on 10% to retirement and $2400 a year for insurance, right off the top, and a 3% state tax.