this post was submitted on 04 Sep 2024

8 points (75.0% liked)

Investing

791 readers

3 users here now

A community for discussing investing news.

Rules:

- No bigotry: Including racism, sexism, homophobia, transphobia, or xenophobia. Code of Conduct.

- Be respectful. Everyone should feel welcome here.

- No NSFW content.

- No Ads / Spamming.

- Be thoughtful and helpful: even with ‘stupid’ questions. The world won’t be made better or worse by snarky comments schooling naive newcomers on Lemmy.

founded 1 year ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

Are you planning on day trading? Do you have access to information that other day traders do not? If not, I would put everything into a mutual fund and forget about it. Until you have more money, then I would put that money into the same mutual fund and forget about it.

Or, try buying individual stocks for a year, and see if your layman's picks outperformed a normal mutual fund. If you did not beat the mutual fund, then you have discovered why you should put everything in a mutual fund and forget about it.

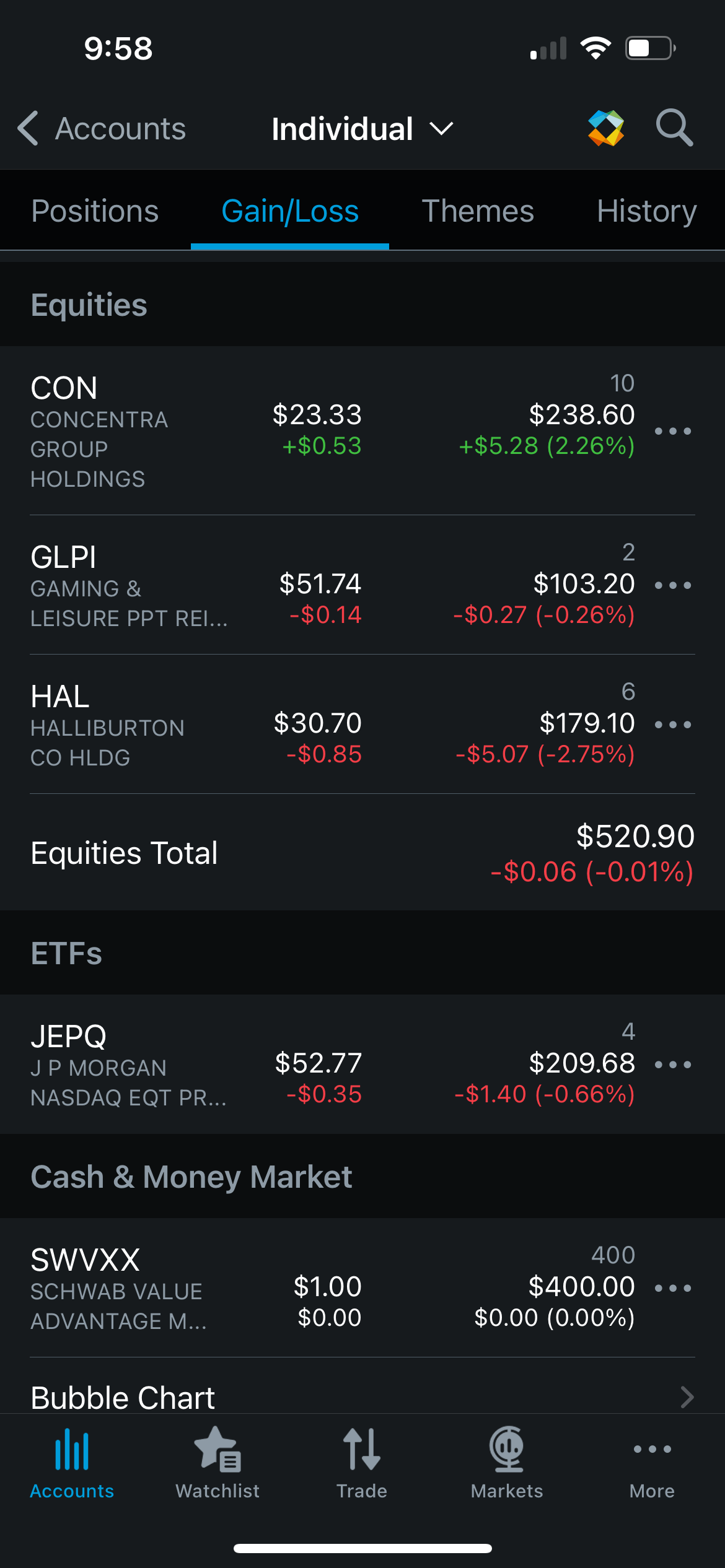

Yeah I definitely see what you’re saying but I would like to actively manage my own money. I’ll have a split portfolio so I’ll definitely have a decent amount in a mutual fund of sorts. Are these basically the Schwab money markets I see or do you mean like real mutual funds? They typically have minimum investments im no where near being able to afford.

There are tons of mutual funds, worth doing research there. I like Vanguard Growth index fund myself.

I think the idea that a clever young man can beat the market by making clever individual stock trades is a myth perpetuated by wall street to keep folks throwing money into the market. Casino owners want people to think that they can hit it big if they try their luck.

If your car needed a new engine, would you do this yourself or hire a professional? If your house had a gas leak, would you fix it yourself or hire a professional? Why then would you manage your own investments if you're not a financial advisor?

If you're interested in it as a hobby, put 90% of your money in a mutual fund and play slot machines with other 10%. But don't presume that playing slot machines with 100% of your savings is a sound investment strategy.

Trading individual stocks is free. Mutual funds have a minimum buy in. Your local high school theater is free to attend. Hamilton tickets are $500 minimum. This is because one of these things is worth attending.